Deep DAO Liquidity

Being and owner and participant in a number of DAOs, I, of course, have encountered discussions of how to provide community support. This both from a number of Tokenomic perspectives (DAOs to fund development, biz, ops), but also from inside of how we do spend for what. One of the key issues with DAOs is capital resources and trading liquidity. This paper focuses on this one component of Community value building Tokenomic Liquidity (ignoring IP, people, and other important business components).

What does it mean to create community value?

What does it mean to create Deep DAO liquidity?

From a Tokenomic perspective, I have multiple data points that conclusively show pairing a community token with a ‘stable value’ (to be equated with DAI, USDC, and other equivalents) provides not just a better return to LP holders but actually provides a better value base for the community. In the loosest sense, a coin that has some stable value is a much better token to pair with than one that has high market correlation. The reasons are straightforward. Since a stablecoin holds value, the LP-stablecoin acts as a liquidity provider when the price rises and liquidity absorber when the price falls. The Uniswap v2 AMM model is pretty nice in the sense that the LP is strictly democratic (all liquidity shares all fees equally). It also automatically reinvests fees, and more importantly, the Token price can’t crash to zero unless liquidity leaves the contract. This is NOT true for either CEX’s, or Uniswap v3.

Historically, the prices of all tokens were strongly coupled to Bitcoin because all the highly liquid CEX trading pairs were Token-BTC. Now with ETH, we also have markets in Token-ETH. We have DEXs that also have a lot of liquidity distributed between many different pairs. Most of these obscure pairs have pretty high slippage.

What I am proposing to the crypto community at large, and particularly smaller DAOs just starting up (market caps < 50M) is for them to focus building Liquidity in one stablecoin pair on each network. Use stablecoins as the pass through point from Token1-Token2. This means if one wants to get to ETH or BTC, those networks and exchanges only need to have strong ETH-Stablecoin and BTC-Stablecoin pairs. Concentrating liquidity in this way focuses trading, and fees will for the most part only be 2-hop fees. Slippage in the above model is reduced to a minimum when primary Token liquidity is built into a single pair.

Focusing on the above will reduce strong token-token price correlations that we still see today.

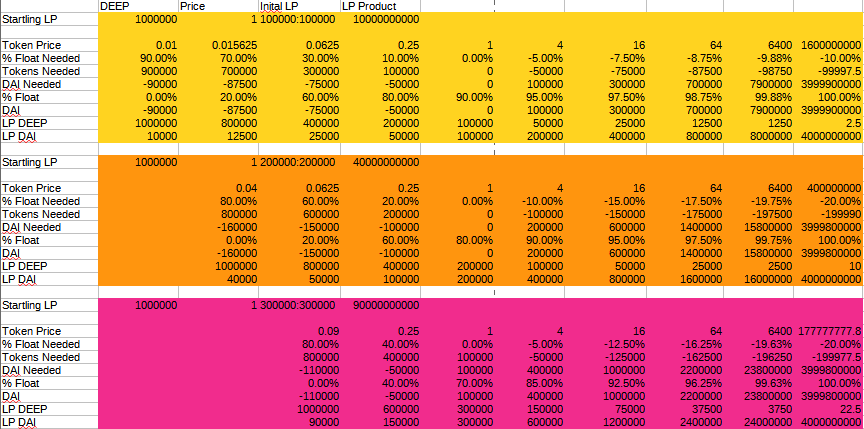

To back this idea, lets look at what the Uniswap V2 contract does for a Token called DEEP against DAI with various levels of LP.

Say DEEP has 1M tokens outstanding (issued or equally called the float - what the market has to buy and sell).

Lets say DEEP is worth 1 DAI and look at how much the price can move in the Uniswap TOken-DAI liquidity contract based on how many % of the float is locked in the contract at the 1DAI/TOKEN price ratio.

One can run the numbers on these and we find. if one can get to 33.33% of all the liquidity in one or more contracts that the price can’t change by more than a factor of 10 down (90% down) because it would take more than all the rest of the available liquidity to make that happen. With 10% of available liquidity the price can drop a factor of 100 (or 99% down), etc.

If this liquidity were split between DEEP-DAI and DEEP-ETH say and the DEEP price was perfectly 1:1 correlated with ETH then the 15% of the DEEP liquidity in the DEEP-ETH pair would be useless in the above calculation because there would be no change in the DEEP-ETH ratio while the price of DEEP dropped 4x this pair wouldn’t give or soak up liquidity where as the DEEP-DAI would. Contrast this with if the above liquidity was split between stablecoins. In this case the liquidity/price calculation above is valid and there would further be arbitrage opportunities between the DEEP-DAI and DEEP-USDC liquidity BUT in this case the trade slippage would be larger by sqrt(2) on each pair.

Now due to the fact that bridging between networks has a time and expense component, often times there is a reason to split liquidity between networks, but as long as communities realize this split should occur so that the token deep liquidity is sought against a stablecoin then price support via network arbitrage across networks will retain the above characteristics. This is because the pairing is always against a coin of hard stable value vs. one that fluctuates, is weakly correlated, or worse is significantly correlated.

There is an additional point that seems to be lost on people with respect to LP and that is in relation to trade volumes. In the above examples if the price of DEEP falls, $1M worth of Token-stablecoin trading will actually increase LP returns, where as if the price of the DEEP increases it will decrease returns. This is because the total value of the LP in $$ decreases if the DEEP price decreases and also increases in v2 as the sqrt of price. The reverse is true if 1M Tokens want to trade in that if the price of DEEP in DAI decreases, it will increase the amount of Tokens and hence the LP return will be reduced, where as if the DEEP DAI price increases since there will be less LP in the contract 1M tokens trading will increase the LP returns. This means that LP returns when paired against stablecoins vary based on whether the price is down relative to the stablecoin and whether money wants to enter at low DEEP prices or TOKENS want to exit at high DEEP prices (both are good for LP returns). Where it gets worse for LP returns is when TOKENS want to exit at low DEEP prices or money wants to enter at high DEEP prices.

The above is particularly important when looked at from a LP fee return perspective and whether Token holders are seeking to trade to exit to cash, or cash is looking to enter. If sufficient LP exists and is ‘sticky’ then this LP will provide a price floor based on examples above. Put simply the more cash that is paired with Tokens in the Token-Stablecoin LP the better the price support for Tokenholders to exit. LP fees might go down (often during these periods they temporarily go up because the volume is high) but at some point the price will stabilize and the LP will end up with a greater percentage of all Tokens paired with less cash (making it even harder for the price to drop unless LP leaves). Now if the price goes up, the only limit to how high the price can rise is the liquidity in the stablecoin, and since LP fees will increase it means that provided no LP tokens redeem and more add - that the price floor has theoretically increased. I provided 4B DAI limits since the liquidity of the stablecoin is the effective high price limit in the LP. This is what I mean by building community value. The more Token liquidity is paired with a Stablecoin the greater the price floor. I consider the above one of the biggest metrics on whether a community is creating real value. The net percentage of their tokens locked in LPs. Communities can choose to pair with BTC or wETH and tie their futures to the changes in prices of those commodities or they can choose to build community value against a hard currency that is designed not to change as much in value (stablecoins).

I am going to leave the debate on what is a ‘hard currency’ because almost all currencies($$, EUR, YEN, etc.) are inflating at high values. I choose $$ based stablecoins because at the moment the USD is one of the most utilized currencies and we have the highest liquidity in USD based stablecoins. The key point in building DeepLiquidity is to pair Tokens in liquidity contracts against coins that have a relatively constant or uncorrelated value so that these liquidity contracts sop up and release liquidity due to price changes. What we have seen is that ETH and BTC are generally bad tokens to pair with because if ETH or BTC price moves dramatically the Token prices will as well. Who is going to want to own ETH or worse buy ETH that is significantly decreasing in price to support some ETH-Token pair either by providing arbitrage trading, or Liquidity for trading? It is bad enough holding a Token that is decreasing in price, but if you hold two tokens decreasing in price by the same amount your LP earns no fees, the losses are multiplied (no longer does IL go as the sqrt of price).

To summarize the basic points of this paper.

- To build community Tokenomic value Tokens should be paired with the most liquid stablecoins.

- To build Token price support at least 1/3 of the community token should be paired with stablecoins at as high of a price as possible. The higher the percentage paired the stronger the low end price support.

- To reduce trade slippage, the above liquidity should be focused on a single stablecoin with the highest network trade liquidity to ETH and BTC, so that trades using the stablecoins as intermediaries will have high liquidity. If a DEX offers farming rewards they should ideally focus rewards on ETH-Stablecoin, BTC-Stablecoin and then Token-Stablecoin and at all costs try to avoid pairings like Token-ETH or Token-BTC and Token1-Token2 as these will just increase price correlation, reduce ability of the LP to soak up or release liquidity, and increase slippage on trades.

One other point here I realized I need to add.

Liquidity Positions with Token-Stablecoin experience losses or gains as the sqrt of the price. If the price on a Token-stablecoin quadruples the LP value will double. If the price of a Token drops by 75% the LP value drops by 50% this is adds a very powerful asset value stabilization mechanism to the DAO portfolio and with the above one of the most powerful community value building and Tokenomic liquidity management mechanisms for a DAO.