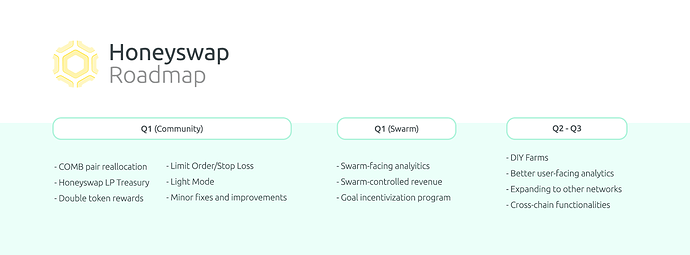

Given the recent conversations about Honeyswap, I wanted to put together a roadmap to properly set expectations for our users, investors and contributors.

DISCLAIMER: This cannot be considered the final/official roadmap, these are some ideas that I wanted to discuss with the Tulip developers while receiving feedback from the whole community on the plan that we should follow.

Q1

For the community

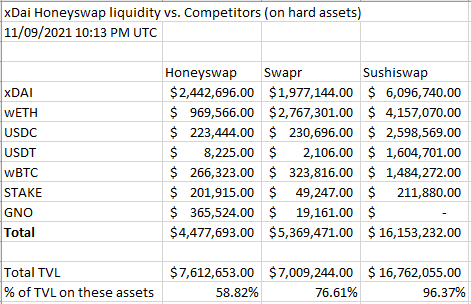

- COMB pair reallocation: Reducing the number of pairs to increase APY, focusing on hard assets, essential tokens to set up favorable market conditions for the communities interested in building liquidity here. As well as ensuring we can do as much as possible to keep up with our competitors.

*date is actually 12/09/2021 10:13 PM UTC

-

Honeyswap LP Treasury: Using HNY from the protocol fee buyback (and some from the common pool if needed) to offer bonds in exchange of a curated set of LPs.

This should reduce the expenses of renting liquidity through liquidity mining programs while building a healthy treasury and ensuring there’s always liquidity on the pairs we care the most.

*maybe we can introduce a dedicated section within the honeyswap app to show the bond offerings? (whether if it’s using olympus pro or setting up our own fork)

- Double token rewards: Introducing a highly requested functionality to our farms that will give us the possibility of collaborating with other communities to keep building liquidity on Honeyswap.

- Gardens/Community Growth Packages: Using the tools developed we’ll be looking into starting a program where communities can count with us as the best partners to help them provide the right market conditions for the investors, contributors and users of their community.

*I’m interested in the idea of asking GNO incentives for programs like these

- Limit Order/Stop Loss: Thanks to our friends at Autonomy, we’ll be able to offer more trading options to our users.

- Light Mode: A slight accessibility improvement that can help our users adapt to whatever mode they need.

- Minor fixes and improvements: We’re always on the look to protect our Honey from bugs with our spiky stings.

For the swarm

- Swarm-facing analytics: We want to be able to measure the results of past efforts and know with certainty what steps to take next.

- Swarm-controlled revenue: We’ll now be receiving the HNY bought back from the protocol fee directly into our multisig to be used to cover expenses and fund other initiatives.

- Goal incentivization program: We’ll allocate a portion of the protocol revenue to be distributed as an extra to our contributors if we meet certain goals on a monthly? period.

While we deliver on these great updates, we’ll be doing some research for new improvements, some stuff that we may see on Q2 is:

Q2-Q3

- DIY Farms: Expanding our efforts to provide the right tools to build liquidity, we want to be able to provide permissionless farms where everyone can specify the LP and provide the desired token for rewards.

- Better user-facing analytics: At this point we want everyone to be able to make more informed decisions when providing liquidity or interacting with the protocol at all.

-

Expanding to other networks: Assuming that we get a positive outcome from the efforts at Q1 and early Q2 we will be looking into applying these to more networks, starting with Polygon, where we already have a deployment.

We could not just apply what we learnt on xDai, but we could also use some of the Honeyswap LP Treasury to bridge some funds and set up some base liquidity there as well. - Cross-chain functionalities: Having xPollinate shown success, I’m pretty sure we can do something with that, whether something as simple as hooking up xPollinate into our interface or as complex as making cross chain swaps.

Thank you for reading through and please leave your feedback on the comments. Do this seem doable? Should we prioritize other stuff?

Thanks @Efra for the design.