Proposal Title

Proposal Information

Proposal description:

This proposal is to bring back and fund the Tulip Swarm: New Colony

Proposal Rationale

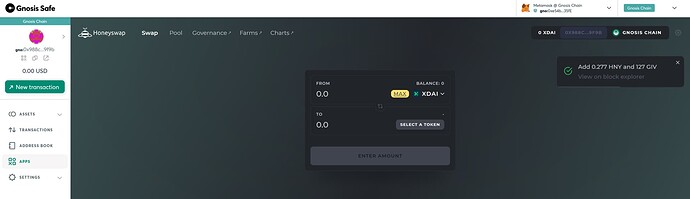

Last time a proposal for Tulip was posted it did not generate enough conviction. The abscence of a team behind Honeyswap is felt throughout the community and we recognize the advantages of having DeFi tools at our hands.

That’s why I have decided to put my time and resources available into continuing with the development of Honeyswap with a special focus on leveraging Gardens.

Important posts to look at regarding this:

- Honeyswap alignment with Gardens

- Honeyswap roadmap planning call Nov. 23rd

- Ideas for a Honeyswap roadmap

We’ll be keeping track of meetings, hours and funds in the following Drive folder: Tulip Folder

Expected duration or delivery date (if applicable):

I expect this budgest to last about 1 month and a half. We’ll try to work on as much features outlined in the Roadmap as possible, priorities haven’t been discussed yet so feel free to comment on what we should focus our efforts first.

Team Information (For Funding Proposals)

Names, usernames, and/or relevant social links for team members (Twitter, Github, 1Hive Forum, etc.):

@hernandoagf, @striker, @D0SH, @saltorious, @solarmkd, @Efra, @eenti

Skills and previous experience in related or similar work:

We’ve all been involved in 1Hive for quite some time, in that list we have devs, designers, marketing and PM.

Funding Information (For Funding Proposals)

Amount of HNY requested:

75

Ethereum address where funds shall be transferred:

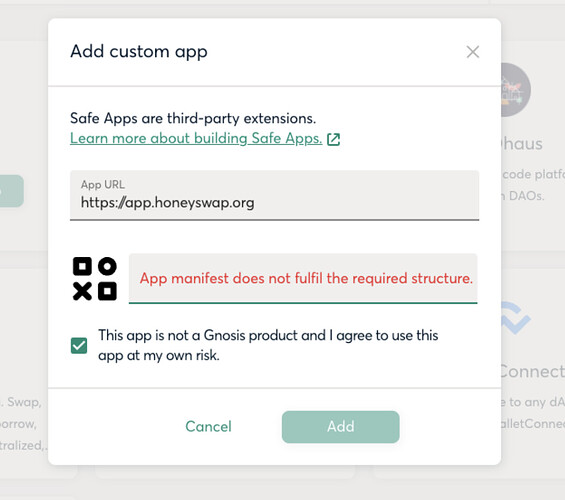

New Tulip Colony: 0x38Bbaf44428aC2752F039d30ef937a30C6B88CC4

More detailed description of how funds will be handled and used:

About payments: Payments will be made in HNY at its dollar value every week. Only the hours of completed issues will be paid, if the task is very large or was left in the middle, the contributor will be able to reach an agreement with the Swarm to receive compensation for their hours.

We’ll also distribute a portion of the HNY received from the protocol fee to our contributors if certain goals are met at the end of each month, if we manage to grow the protocol, payments will grow too.

About what’s going to be delivered: We are planning to accomplish a wide array of tasks including:

- Limit Order/Stop Loss functionalities

- Deactivating the lock option on the farms (this will give us some cooldown period to reallocate pairs without much hassle)

- Double token rewards

- Swarm-facing analytics to make more informed moves