I strongly disagree with most of these points.

The points I believe have merit are governance with a multisig and the risk of a hacked project minting infinite tokens. And while this proposal isn’t perfect, it significantly improves on the status quo for these concerns!

-

Governance with a multisig. Yes, we need to build a better governance system for shared liquidity, but Water is still a big improvement on current multisigs, which are the status quo. Water is a 5 of 12 multisig with members from 7 different projects. Our shared liquidity with Shapeshift and BrightID, and BrightID’s shared liquidity with Giveth, are all 4 of 6 multisigs with members from 2 projects. Honeyswap’s liquidity incentives are also managed by a multisig, which still hasn’t been able to switch STAKE<>xDAI rewards to GNO<>xDAI, 4 months after the merge. Our current liquidity governance is not in good shape.

-

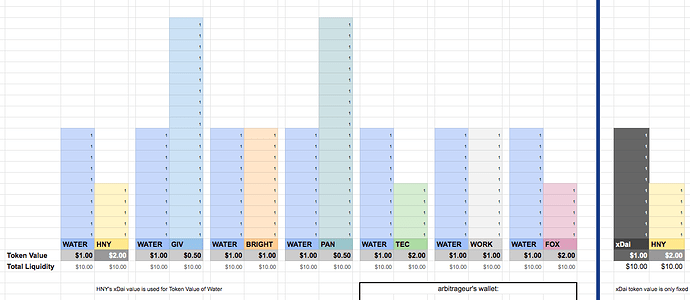

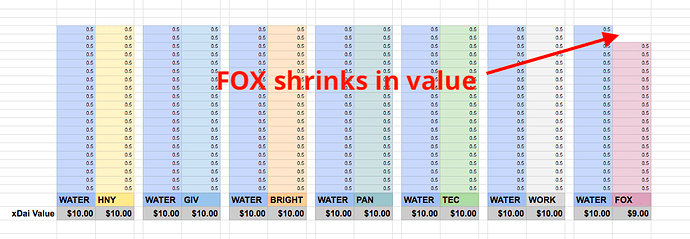

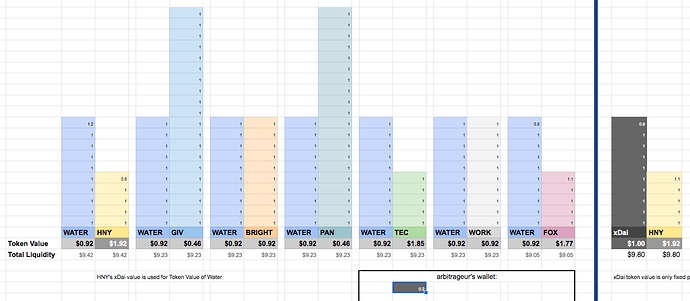

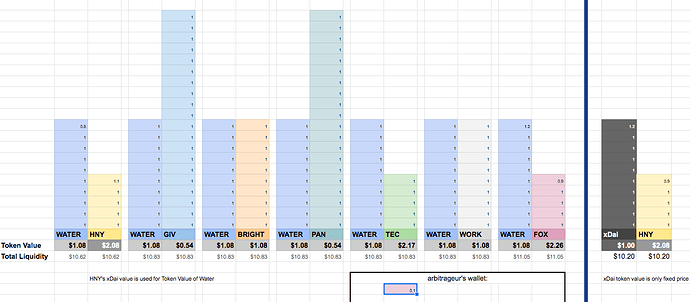

Hacked project minting infinite tokens. The risk here is that a project with significant liquidity outside of their $WATER LP could be hacked and infinite tokens minted, which would disproportionately affect $WATER’s price beyond just that project’s share of the LPs. For this to happen, the malicious tokens would be minted and sold for other tokens with $WATER LP, and an unsuspecting arbitration bot would then buy those tokens in the $WATER LP and sell them through the token’s other LPs with more liquidity, until either those LPs were also drained or the arb bot was drained. A few important notes about this risk:

- This type of hack isn’t possible on a Gardens DAO with dynamic issuance.

- For this hack to be effective you need both rich, lazily built arb bots and a vulnerable project with a lot of liquidity outside of $WATER, which are generally the more mature projects. In this unlikely combination of exploits, the maximum price effect for HNY is still the same as our current shared liquidity proposals, where our paired LP token could $0. (OK, slightly more because we share liquidity directly with other tokens that will also have $WATER LPs, but this is more reason to move from direct shared liquidity to a shared liquidity token to reduce this risk).

- In this type of hack, a multisig is actually better equipped to prevent damage than conviction voting or another form of on-chain governance. On-chain voting is slower and would take more time to remove a harmful LP. For a governance comparison, it took Giveth 20 days to turn off liquidity rewards that were being abused on Uni v3.

To address the other points:

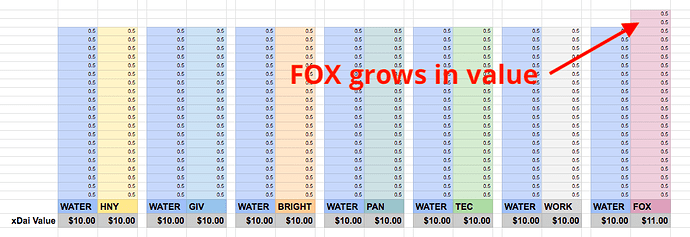

- Liquidity is a critically valuable part of token economies - they are the highways that allow value to move around. A token that facilitates that movement of value is inherently valuable.

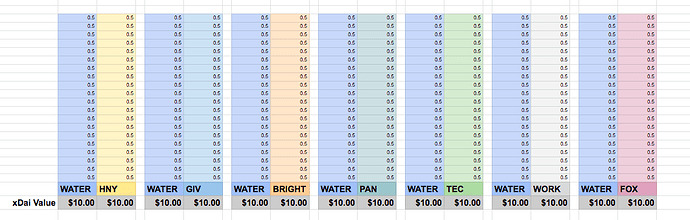

- The dynamics that correlate token prices of Uni v2 style LPs are relatively simple to understand. I still support blockchain engineers modeling this price correlation if they haven’t already.

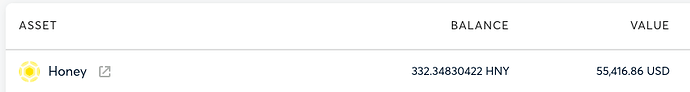

- Adding to @Monstrosity’s points on the proposal as a % of the Common Pool, building sustainable liquidity is a productive use of Common Pool funds, and since $WATER will function similar to an index fund of paired tokens, it’s likely to have a positive effect on $HNY’s token price as well.