Sem… working on a more comprehensive launch doc which I’ll share here. I agree that there are important aspects of this launch that aren’t fully addressed yet.

Right now I want to cover the economic model of Water in more detail, because I think your comments come from a misunderstanding of either the proposal or of how uni v2 style decentralized exchanges work.

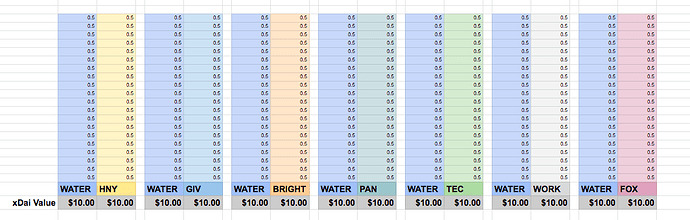

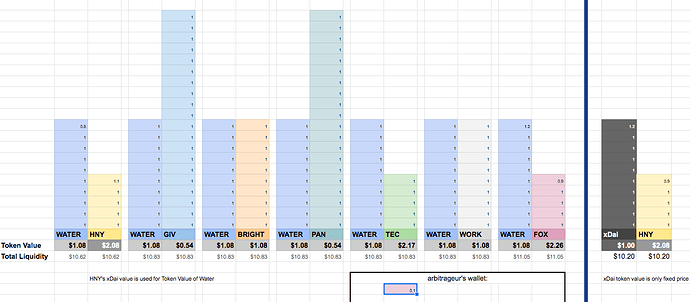

In the example below all 7 of the interested communities have joined Water. Here’s the spreadsheet which you can copy and play around with yourself. At equilibrium, the xDai values of each of the LPs are equal, and look like this:

But the individual token values for each community are different, so when looking at the unit values in each LP, it’ll reflect that. To make the model simpler I set all token prices to either $0.50, $1, or $2 to start, and included the HNY<>xDAI pair which is important in this economy as the top xDAI pair:

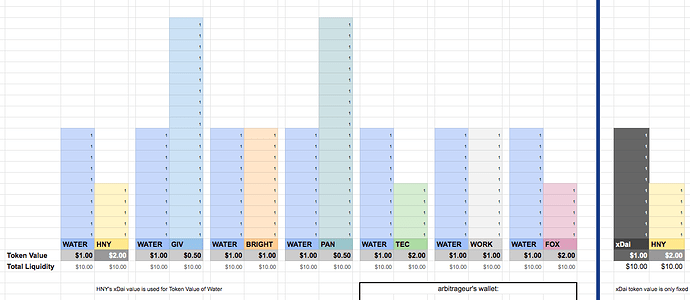

^ in this screenshot:

- the only fixed token price is xDai @$1

- the xDai value of HNY determines the Token Value of WATER, which then determines the Token Value of all other tokens

- Total Liquidity = # of units in pool * Token Value

So what happens if the value of one of the tokens goes down? i.e. the token can be bought for a lower price somewhere else, but really this encompasses every imaginable reason a token goes down in value, which you can boil down to “people like owning that token less.”

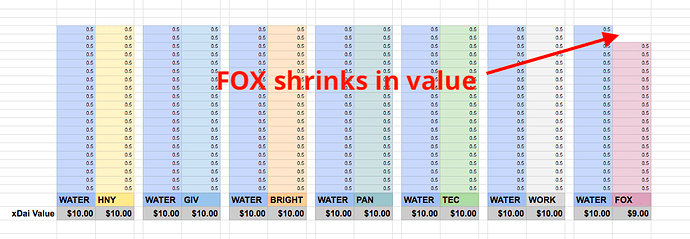

Here is what the xDAI value LP chart looks like if the value of FOX has gone down:

Someone can now presumably buy FOX at a lower price somewhere else and sell it for $2 in the WATER ecosystem.

Assuming they want to cash it out for xDAI, the trade they’ll make is FOX > WATER > HNY > xDAI

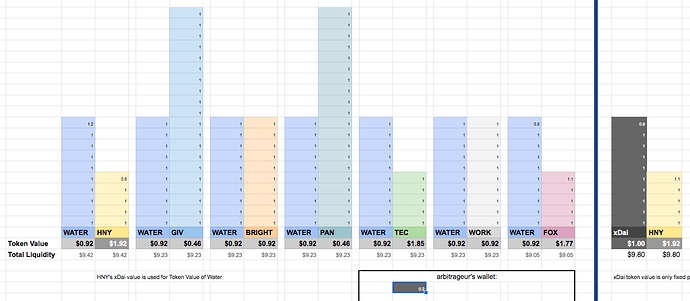

This model assumes that price slippage will return the ecosystem to equilibrium when 0.1 $FOX is sold. Here’s what the unit value model looks like after that trade:

Damn! That was pretty cool. What happened?

- All token prices have gone down

- FOX’s price has gone down the most

- HNY’s token price has gone down the least. Being the top xDAI pair dampens the price effect on HNY since it’s being bought in the HNY<>WATER pair

- The price effect on WATER is the same as for all other tokens in the ecosystem

- We’re back in equilibrium!

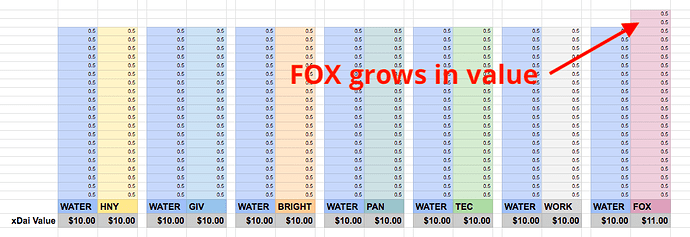

Now let’s look at the opposite, more pleasant event where FOX has gone up in value:

The arbitrage opportunity in this event is to buy FOX at $2 in the WATER ecosystem, since it can presumably be sold for more somewhere else. If the arbitrageur starts with xDAI, their trade will be xDAI > HNY > WATER > FOX. Again we’ll say equilibrium returns when 0.1 $FOX is bought:

Damn! That was even more cool! People are way happier now:

- All token prices have gone up

- FOX’s price has gone up the most

- HNY’s price has gone up the least, since it’s being sold in the HNY<>WATER pair

- The price effect on WATER is the same as for all other tokens in the ecosystem

- We’re back in equilibrium!

With this I want to clear up some misunderstandings in your posts:

Because of arbitrage and price slippage, the price of WATER is a function of the prices of tokens it’s paired with.

There are no WATER tokenholders. 100% of circulating WATER at launch lives in liquidity pools. Unless you mean the arbitrageurs buying and selling WATER for their work, but they’re being compensated for the service of keeping the greater Honeyswap exchange in price equilibrium.

Anyone may choose to buy and hold WATER after launch if they like it as an index token, and that would benefit all the token communities in WATER. But investors and arbitrageurs aren’t able to sink WATER below its index token value because its entire initial supply lives in LPs.

The WATER board does not actively manage LPs, arbitrageurs play the role of active managers for WATER, and their incentives are well-aligned. The WATER board is only needed to remove liquidity when a community asks them to, or when a token is compromised. In the case of a hacked/failing token, WATER board members are personally motivated to remove that LP since it’ll negatively affect the price of the token’s they represent.

Communities are not providing tokens to WATER as an investment. They are paying for the valuable service of sustainable liquidity for their token.

This is the reasoning behind the 15% fee for RageQuitting. Participating communities should have the option to leave, but since WATER’s price could grow quite a bit, it might become tempting for those communities to treat it like an investment and try to add or remove WATER liquidity to maximize profit. This goes against the purpose of WATER which is to provide affordable, long-term liquidity.