Thanks for taking the time to write out the description of the 2 models. I feel like I am immediately biased to giving HNY more utility by using it as the governance token for xBalancer. Although, I am also a little fuzzy on what gives HSF value, but I believe it was conceived of in order to provide a reward token that did not put sell pressure on HNY. I am not sure what would prevent it from continually losing value as it was traded in for other tokens though. Perhaps with some sort of buy back and burn mechanism. I would be interested to learn more about this and how it might fit in to the xBalancer protocol. I would be interested in hanging in a Discord chat tomorrow evening eastern time, but will wait to see what those that are more familiar with the HSF/HNY tokenomics have to say.

Great to see this progress on the DAO model. Could you please ensure that is either an update here or in one of the discords provided as a PING or @everybody so that the time of the call can be broadcast in advance. I would also like to listen in to this time permitting.

I’ve submitted the proposal to the 1hive DAO and made a couple of important changes to the proposal on our Medium post.

-

I’ve added more details about what the 75 HNY covers. I intend to create budgets on our DAO and publish expenses to be as transparent as possible.

-

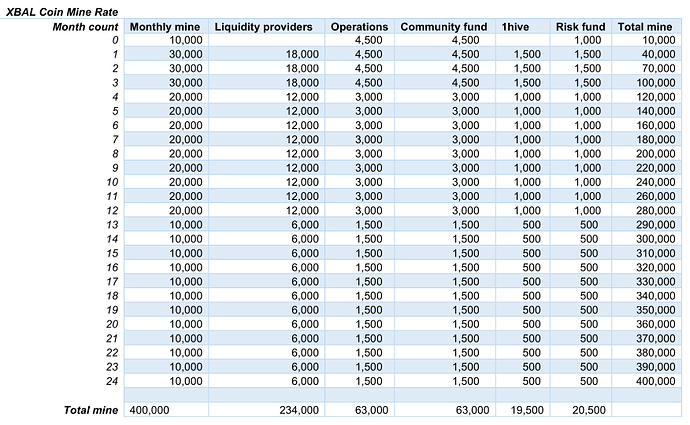

Rather than start with 1 token we now start with 10,000 tokens. This is to support airdrops and governance plus a small allocation to start the insurance fund. Community is so important so above all we decided we needed a fund at the start to get people involved in the project and DAO straight away.

The time line target is 1 month but for transparency this could go as far as two months. The reason is the audit, we don’t yet know how long the audit will take but initially we’ve been told up to 6 weeks for a full audit but since we’re hoping to use the same auditors who carried out the original Balancer audit this should be compressed to just an audit of the small number of deltas. So we’re pushing hard for one month but the audit is outside of our control so the caveat is if the audit takes longer then we will delay because it’s in no ones interest to launch before there’s a clean bill of health from the auditor.

Will this take some liquidity away from HoneySwap? Maybe, but SushiSwap is already on xDai and at least we are part of this project. I know there are diehard balancers, diehard unis, diehard sushi… lets bring them all over to xDai!

I have a feeling that many members are having some doubts about the proposal.

Can you explain who will be responsible for operations budget and what are the community and risk funds ?

If operations budget are Cent Finance how do we make sure and feel safe that you will not rugpull 1hive and decide to change the terms of the distribution ? Will you use voting for the distribution ?

This is one reason we don’t want to delay and launch Balancer V2.

Balancer V1 launched and quickly ran into problems including a hack. Since then the project has undergone numerous changes to the point that it’s stable today. If you look on Coingecko at the performance of Balancer, SushiSwap, UniSwap, HoneySwap over the past 30 days or shorter or longer term, whether coin price, trade volume or market cap you’ll see that Balancer has shown greater gains than all. HoneySwap is a great project but SushiSwap’s announcement could be a challenge. It’ll bring more liquidity to xDai hopefully but how much spills over to HoneySwap is yet to be seen. I think part of the reason we’re seeing a down trend is that the market is concerned about the impact of a giant like SushiSwap moving in.

By contrast, Balancer Labs has said there’s no interest in moving networks even though that’s the most requested change by its own community. So I think xBalancer is ideally positioned to tap into new liquidity from SushiSwap and from Balancer now that SushiSwap has set this precedent.

But waiting and launching Balancer V2 runs a number of risks IMO. Firstly, Balancer V2 hasn’t launched yet so we don’t know yet how it’ll perform. V1 had issues that took time to address, V2 could have its own issues. I would prefer to launch a stable V1 early with the option of rolling out a stable V2 after six months. Any vulnerabilities will likely be known by then, confidence in the new platform will be higher and we can launch with the same DAO and XBAL coins while new pools will take minutes to set up.

The operations budget goes into a bucket that is administered by Cent Finance on behalf of the operations team. Operations expenses are paid from this and after vesting periods members of operations can take possession of coins. This ensures there’s an active operations team but team members can’t just take the coins and down tools.

For the first month since there’s no large pre-mine then operations along with community will be involved in voting on matters. However, as LP’s start to earn XBAL coins it’s intended that operations will increasingly abstain from votes except where community and LP can’t get enough people to fulfil a vote and it’s considered in the communities best interest to complete a vote. In this situation operations would be expected to vote along the same lines as the current vote. For example, if 25% voted NO and 75% voted YES but only 0.5% of people voted then operations could use their vote to vote 25% NO and 75% YES. It’s not a hard and fixed rule however, operations can vote on issues but will quickly become a minority and so in practice only be voting when it’s strongly felt to be in the communities interest and even then can be easily outvoted as a minority token holder. The largest coin distribution is to LP’s and so ultimately it’s expected that LP’s will become the most influential.

Community budget covers bounties and other claims by DAO members. We intend to use the Aragon GitHub integration to maintain a backlog of tasks that can have bounties associated to them. Bounties might be for pieces of development, testing, community events, producing guides and materials, branding work, airdrops, new token pairs, training camps or anything else that the DAO feels brings value.

Risk fund is a fund that can be claimed against by liquidity providers who feel they have lost money stemming from a fault in an underlying asset. Lets say a hacker finds a vulnerability in a Uniswap core contract and drains pools causing a crash in the price of UNI (and other coins). A liquidity provider reacts as quickly as possible to withdraw his funds but he still suffers a loss. None of this was the responsibility of xBalancer but we still allow those people who lost funds to put in a claim against this risk fund to get some of their losses back. Sure we don’t have to but it’s good practice to provide some level of protection to people investing into funds or providing liquidity to pools. Each month that fund grows and so by the time a problem happens to an asset there should be enough to be of help.

Keep in mind that this project spun out of Cent Finance who’s mission statement is responsible access to decentralised finance whether that’s encouraging people to complete person policy statements to understand the risks of investing in DeFi, whether that’s paying attention to the assets being listed, whether that’s not rushing out new technology like Balancer V2 before its been battle tested or whether that’s providing some level of protection to LP’s.

Voting is for community spending is by the DAO and it’s expected that operations won’t be voting on those matters. Operations can advise and have its say but generally it will allow the DAO minus operations decide on how community funding is distributed. The DAO can’t vote to not pay its risk protection fund. Operations is responsible for the operations budget because we want to avoid death by inaction where we can’t operationally do anything without a vote. There has to be a level of common sense here. If a zero day is discovered we need to act straight away, it’s not in anyone’s interest to announce a vote to fix the vulnerability. The same applies to activity to find new sources of liquidity, ensure momentum in all areas from community support to development. Operations is an employed team that needs to earn, community is people picking up bounties as they are able to.

As for pulling the rug, it’s 75 HNY. If the intention was to run off with the money it would need to be for a lot more than 75 HNY, we’ve already spent more than that in man hours getting to this point. We would have declared intent to do the work, take the money then leave, not build the property then ask for the decoration money and leave the house behind.

I do appreciate the concerns raised but it has to be appreciated that a lot of work has gone into getting xBalancer to where it is and when we priced 75 HNY the price was around $1300 per HNY and now it’s less than $800 and yet we haven’t tried to increase that total. That 75 HNY ($60,000) for an ongoing commitment of 5% of all future mining is an exceptionally high ROI, indeed we stuck with that value to create a high reward incentive for 1hive who would benefit financially far more than xBalancer over the coming months.

The HNY itself is the least important element in what we want to get from a partnership. We came to xDai for very practical reasons, we wanted to launch on a network with low fees and an active community. We came to 1hive to be part of the active community on xDai, that remains what we consider most important. I will be equally happy to not receive the 75 HNY and split the 5% between community and operations fund of xBalancer. This would see a portion of that still going to the 1hive community due to some community crossover. We would continue to be close partners with the 1hive community and support 1hive projects since that was our intention when coming to xDai and before the idea of raising HNY was even raised. A strong 1hive is good for the xDai and so we’d want to see 1hive flourish whether we had a binding between the DAO’s or not and our airdrops would still include the 1hive community members.

It may prove to be too challenging to align xBalancer with 1hive. We submitted the proposal to feel out the community interest. As a true DAO I’m sure 1hive will decide wisely and I respect the final decision of the DAO. If there’s any uncertainty then it would be wise to stick with a partnership as friends and neighbours since I’m sure both communities will overlap significantly and want to support each other as the xDai community undergoes change.

Is there a telegram or discord group for this project yet?