DeFi insurance products such as opium.finance offer insurances for few products, things such as USDT protection and bridge protections to sidechains.

Seeing the recent DeFi scam explosion (looking at everything on the rekt.news leaderboards) it could be sensible to create essentially insurance for high beta yield bearing opportunities (aka shitcoin farms) on Polygon or on future chains 1Hive and these shitcoin farms will be deploying to.

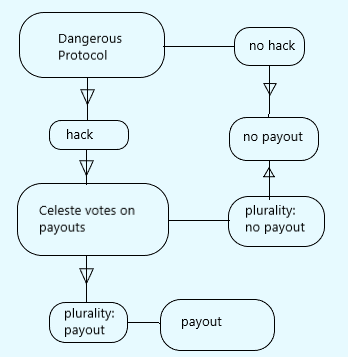

I suppose the system could work by having an obviously high premium for the insurances, which should anyways attract buyers since they expect to make much more than the high premiums. Insurance payouts would be voted on by Celeste and the only tricky part that remains is calculating the premium prices / coverage for the protocol. I would be excited to work on this if you guys also have interest in it.

Premiums would be payed for in stablecoins and if the insurance is used it would be paid out in stablecoins, there exists the option of using HNY in a Maker-DAO type of way to collateralize insurances, but then there would liquidations ratios etc, so to not reinvent the wheel, it would possibly make more sense to integrate this with Agave and give the user an option to automatically deposit their HNY in Agave, borrow stablecoins, and stake those stables for insurances, it could even be incentivized.

Furthermore, I said that 1Hive could deploy this to any chain it is on, but effectively, this unnecessary, as with Celeste insurance payouts can be handled for ANY protocol that was rugged / exploited on ANY chain.

Effectively this could turn xDai/1Hive into an insurance hub.