Despite the explosion in NFT adoption we’ve seen in 2020 and 2021, there is still a lot of room for improvement with the buyer’s experience around NFT art and collectibles. The problems I see that have not been fully addressed yet include:

- Lack of liquidity in NFT secondary markets. The major NFT marketplaces today are centered around a bid-style marketplace. This results in not being able to get instant liquidity on NFT assets at any time; one has to wait for someone to bid or buy at an asking price.

- Centralized exchanges taking extremely high drop fees. NFT exchanges are monetizing by charging double-digit percent fees for creators to drop NFTs. This value can be passed onto the creator, or can potentially go towards cost savings for the buyer. In addition, so much buyer demand is being sucked up from the primary market auctions and sales. It’s creating an environment where people want to cash in on the primary market while exposing the buyers to potentially a very illiquid secondary market.

- Lack of utility outside of owning the collectible. There are a number of creative ways to add a lot more utility to the ownership of digital art and collectibles.

- Content curation. Curation can be subjective, but I think there can be a lot more tasteful NFTs than some of the drops we’ve seen.

DAOfi has a number of exciting ways to improve the buyer’s experience for digital art and collectibles NFTs.

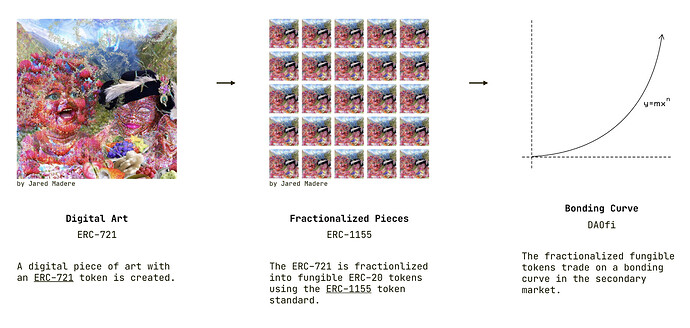

Solving the liquidity problem. In order to solve the NFT liquidity problem, DAOfi will encourage artists to fractionalize a non-fungible ERC-721 into fungible ERC-20s using our take on the ERC-1155 token standard. Owning a single ERC-20 will be like owning piece of the art, much like owning a print. Those fungible ERC-20s will be placed on a bonding curve on DAOfi. Therefore, the AMM on DAOfi will always be able to provide liquidity for buyers and sellers at any time algorithmically. Some of our stakeholders have called DAOfi a “generalized Eulerbeats.” DAOfi is a DEX that is a fork of Uniswap and it also uses math from Bancor as well. We’re really appreciative of the core teams from both Uniswap and Bancor with their assistance. We decided to launch the DEX on xDai network in order to facilitate a more liquid buyer’s experience when trading on the DEX. Our hope is the reduced wait times and lower fees with an EVM sidechain should provide a much better user-experience for buying and selling assets.

The NFT lives in a web page . For many of the art pieces launching on DAOfi, the NFT meta data will point to a URL to where the art is displayed. The web page itself will use a decentralized tech stack where applicable, including IPFS. Many of the art pieces launching on DAOfi will be generative so it makes sense to point the NFT to a web page where the contents can constantly change.

DAOfi Links

DAOfi Links

https://twitter.com/daofidex

Contract: 0xd82bb924a1707950903e2c0a619824024e254cd1

Telegram: https://t.me/daofi

Discord: https://discord.gg/5ndaWRF

Testnet Alpha: https://app.daofi.org/