Currently we have a per block issuance rate which compounds, this is currently set at approximately 60% per year. Edit: the current issuance policy has since been reduced by half and is currently approximately 30% per year rather than 60%

Issuance is hugely important for bootstrapping a DAO in the absence of fee inflows, it ensures that the DAOs asset is flowing and circulating to contributors, rather than getting stuck in the hands of people who may have contributed a bit and then moved on to something else. Once fee inflows are established, value can continue to flow and circulate without issuance, but if value flow ever slows or stops a DAO is as good as dead.

If issuance is too low during the bootstrapping phases, people who contributed a little bit early on and then disappeared reap massive rewards. With issuance set too high, contributing tends to feel less valuable due to the potential for rapid dilution.

Finding the right balance is critically important. Currently honey holders can use governance to adjust the issuance policy (status quo), but discretionary governance over such a critical and central policy is not ideal and doesn’t really align with the governance minimization philosophy that makes 1hive unique. This was not a major concern until recently as 1hive was a much smaller, more tightly coordinated community operating under different trust assumptions.

However now that we have significantly more capital in the honey economy and we have a rapidly growing community of stakeholders establishing a clear, predictable, and more algorithmic supply policy should be a priority.

TLDR: The current issuance policy and governance mechanism controlling it needs to be replaced, the question is when and with what.

Some options:

-

We can disable issuance for now, relying on the existing common pool funds until we can research, model, and propose a more robust issuance mechanism. The main advantage here is it assuages concerns over the current issuance policy, but gives time to carefully consider better alternatives before committing to any specific policy.

-

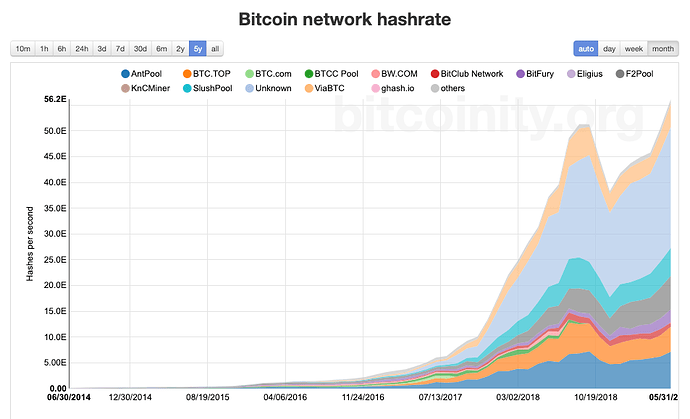

We can issue a fixed amount of honey per block, ensuring that issuance is predictable and decreases over time instead of compounding if left alone. If we want we can also set block intervals, where this rate decreases over time similar to bitcoin. The main advantage of this approach is that its super easy and familiar for crypto people to understand… the main downside is that it doesn’t adapt based inputs so committing to a naive policy now may lead to challenges in the future.

-

We can issue a dynamic amount of honey per block based on the percentage of the supply that is currently in the common pool. Issuance would be 0 so long as there is some minimum percentage of the supply in the common pool, and increase as the balance of Honey in the common pool approaches 0. If fee inflows are greater than outflows, issuance can remain at 0 indefinitely while still ensuring that honey is circulating to contributors. Keep in mind that conviction voting limits the maximum rate at which funds can leave the common pool, so voting to abstain in conviction voting then also becomes a signal to decrease the issuance rate if the common pool is bellow the minimum threshold.

-

???

EDIT: The issuance policy has been updated to 30% per year since this post was made.

. Issuance is a key area that will impact in different dimension our Future organic growth.

. Issuance is a key area that will impact in different dimension our Future organic growth.

), conviction voting would be like the consensus algorithm. Proposals are submitted to the “mempool”, or proposal pool, and “miners” (HNY holders) vote on whether the transaction is valid (the proposal gets paid).

), conviction voting would be like the consensus algorithm. Proposals are submitted to the “mempool”, or proposal pool, and “miners” (HNY holders) vote on whether the transaction is valid (the proposal gets paid).

. But I digress…

. But I digress…