@anisoptera 30k is not arbitrary (based on random choice or personal whim, rather than any reason or system), as it’s based on being the closest multiple of 10k. You mention psychology… psychology is the basis for a rounded supply. Again, 30k is not arbitrary because it’s the closest multiple of 10k to where we currently are. 10k is potentially arbitrary, but I assume that a hard cap would be a multiple of 10k. Are you against a max supply that is a multiple of 10k? If so, please explain your reason. At the end of the day, if you answer any question, I can ask ‘but why’ until you get to an arbitrary basis… there has to be a basis. Dig deep enough on any topic, you’ll reach an ‘arbitrary’ basis.

@anisoptera My statements do not imply that people who participate early should or will have more power. My statement implies that voting rights are cheaper at this point, which make sense, as the platform is less valuable than what it will be. What this also implies is that it’ll be more expensive to have voting rights as time progresses if HNY becomes more valuable. This make a lot of sense. Are you arguing that voting rights shouldn’t be more expensive as the platform become more valuable? Moreover, you’re not taking into consideration that people will buy and sell their HNY. Weak hands will be shaken out and strong hands will emerge. Power dynamics will even out through mechanisms of markets.

Also, each additional token minted does not make it possible for another person to have a vote. Anyone who wants a vote will have to buy their votes (like now). Newly minted HNY is not distributed to individuals who are not already participating in HNY. It follows that the ability to get a vote will require the same activity as now regardless of the supply–one will have to buy HNY for a vote regardless.

@anisoptera The exact amount you reference was 0.00000000001 HNY. I guarantee that I wrote the same number of zeroes as you because I copied and pasted the value like anyone would when inputting an amount. These fractional amounts will be the case regardless and for all digital currency. You mention uHNY. You’re getting way ahead of yourself, as the value of HNY would need to surpass 100k for that conversion to be relevant, at which point, it’s really not a big deal. Gains from 500 to 100k would be tremendous, and much paradigm shifting would occur, at which point, uHNY will organically arise from the need to denote fractional representations.

@anisoptera You state: “…retain its value over that period of time; the dilution would be offset by the increase in value in the economy.” I disagree with this entirely. The value of HNY needs to appreciate, as voting rights will become more valuable over time as the platform gains value. According to incentivization theory, individuals work more efficiently and effectively with incentives. Given the nature of HNY, the incentive is appreciation. Without appreciation, this community is likely to lose valued members as well as miss out on valuable people contributing to the community. Why would someone invest in something that does not benefit them?

Main takeaways:

–Hard cap protects the value of our holdings.

–Our holdings represent votes, which will cost newcomers regardless.

–Weak hand will be shaken out and strong hands will emerge.

–Decimal will be ‘par-for-the-course’ with any decimal.

–The value of our votes should increase in value over time to be inline with the growth of HNYswap value. The appreciation of these votes will also incentivize participation.

CAN WE PLEASE GET A LIVE CHAT GOING AROUND THIS MATTER because looking at many of the comments, there’s much that needs to be clarified regarding monetary policy and contemporary economic theory.

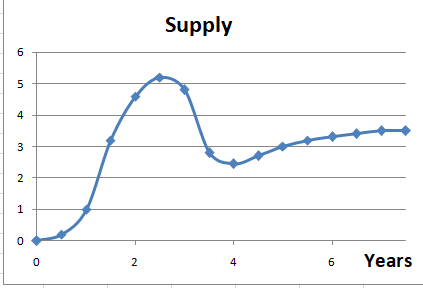

I like @Monstrosity idea, but the inflation rate does not need to precede the max cap. We can fit the inflation rate to meet some max supply.