Proposal Information

This proposal is to fund the 1Hive Hedgey ongoing Treasury Diversification Program.

Supporting this proposal will allocate a constant stream of HNY for our Treasury diversification plan.

You can support this proposal on Gardens (.eth.limo) or Gardens (.org)

Proposal Rationale

Treasury diversification into stablecoins - the Treasury Swarm uses tooling built and maintained by Hedgey Finance to convert Honey into xDai with minimal sell pressure on the Honey token, both with call options and OTC sales for discounted, time-locked Honey.

The program has successfully converted $15k of HNY into stable coins, and continues to generate yield on idle HNY and converting it responsibly to stable coins that benefit the community and the DAO. The long term goal is to build up stable xDAI balances such that those funds would be accessible through Conviction Voting with a multi-token Garden Model, freeing those xDAI balances to be utilized for operating payments required to maintain, operate and run the DAO and its future goals.

Hedgey allows the 1HIVE DAO to sell conditional agreements using HNY. These agreements can generate xDAI revenue for the DAO, as well as diversify the treasury in a transparent way.

Related documents

- Last Treasury Proposal

- Hedgey Runway Contracts

- Hedgey Runway Contracts, Buyers Guide

- Treasury Diversification, Part 1

Expected duration or delivery date

Up to 1 year: the intent is to allow HNY to be deployed up to the limit on a continual basis for responsible DAO Treasury Diversification.

Team Information (For Funding Proposals)

Swarm DAO members with equal weight in control of funds:

@DO$H @Paul2 @solarmkd

Hedgey Team members with equal weight in control of funds:

@icemanparachute

Funding Information (For Funding Proposals)

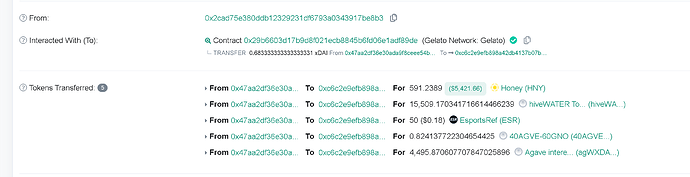

Treasury Swarm Gnosis Safe: 0x47Aa2DF36e30ADa9f8Ceee54b3C8a60FD4787706

More detailed description of how funds will be handled and used:

HNY in this program will be used to create a series of covered calls on the Hedgey protocol. These calls will be available for purchase to the general public. Funds will be deployed from the Gnosis safe multi-sig wallet to the Hedgey Protocol. xDAI received may be deployed into Agave xDAI supply vaults for yield, but the end goal is to be delivered to the DAO to be used for funding ongoing development and DAO general operations and endeavors. HNY may also be used to be deployed in upcoming new products built by Hedgey that have the same goal and intent of covered calls - helping diversification of the 1Hive Treasury. This is a continuation of prior diversification proposals, which have generated over $15k in xDAI that is currently yielding interest but ready to be deployed by the DAO at anytime for various uses.