Proposal Information

Overview:

Proposal description:

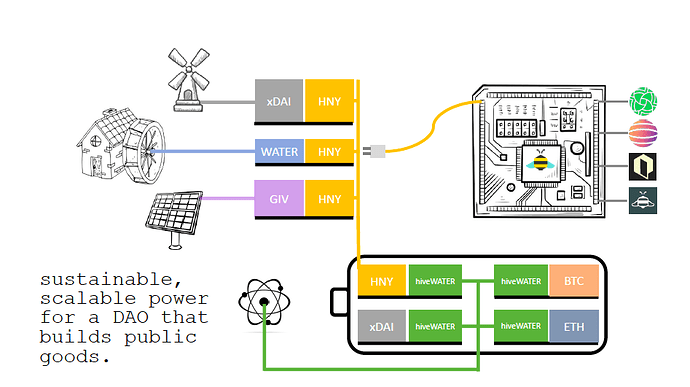

This proposal is requesting 800 HNY (~$10,000) from the Common Pool, along with $8,000 xDAI from the Treasury Swarm Gnosis Safe to fund the creation of hiveWATER, a DAO whose purpose is to provide sustainable, scalable liquidity for the Honey token on Honeyswap by serving as a proxy for liquidity with strategic tokens such as xDAI, WETH, and/or WBTC.

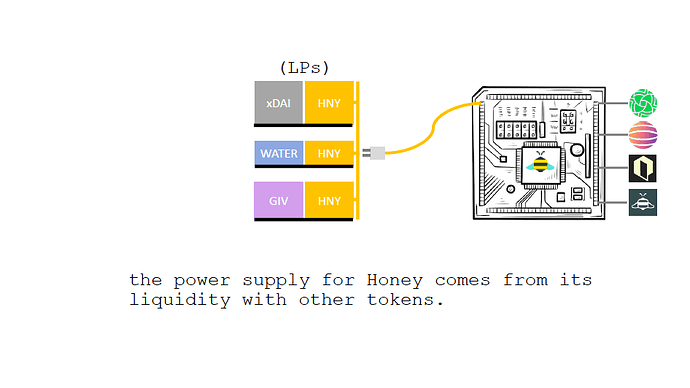

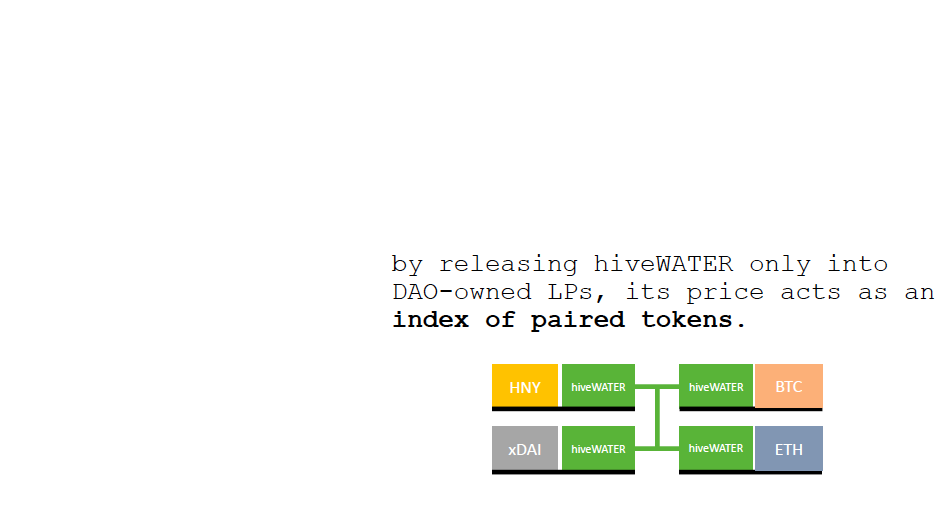

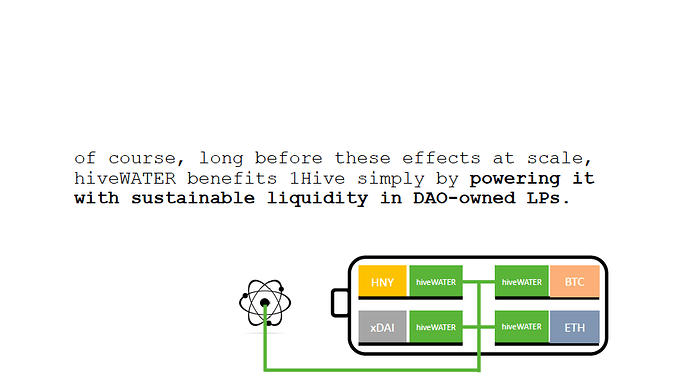

100% of funding from this proposal will be used to create 2 liquidity pools (LPs) on Honeyswap:

hiveWATER/HNY ($20,000 total liquidity)

hiveWATER/xDAI ($16,000 total liquidity)

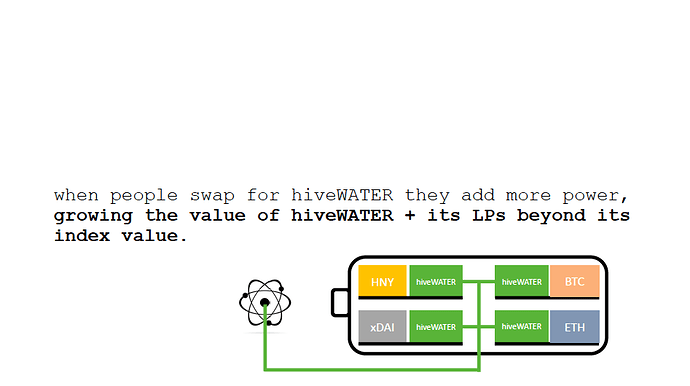

An initial starting price of $0.01 will be set at launch for hiveWATER. This number is arbitrary since hiveWATER’s price after launch will be a function of its price correlation with HNY and xDAI and price slippage from individuals swapping for hiveWATER.

Funds will be added in 2 installments of 400 HNY + $4,000 xDAI each. The 2nd installment will be added when 30% of the circulating supply of hiveWATER is swapped for through the LPs.

If 30% of hiveWATER is not yet bought by 31 May, 2023, LPs will be removed and all HNY and xDAI from the LPs will be returned to 1Hive.

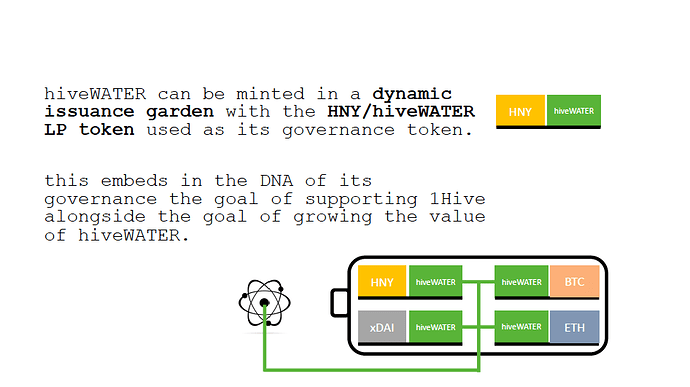

The hiveWATER token will be minted and managed in a Dynamic Issuance Garden using the hiveWATER/HNY LP token on Honeyswap as its governance token. The following governance parameters will be used as the initial setup for the hiveWATER Garden:

Conviction Voting Parameters

Conviction Minimum: 10%

Conviction Growth: 4 days

Spending Limit: 50%

Tao Voting Parameters

Vote Duration: 7 days

Delegated Vote Duration: 4 days

Minimum Quorum: 10%

Support Required: 50%

Quiet Ending: 1 day

Execution Delay: 1 day

Dynamic Issuance Parameters

Initial Supply: 4,000,000

2,000,000 in Common Pool of hiveWATER garden

1,200,000 in hiveWATER/HNY LP (split into 2 additions of 600,000)

800,000 in hiveWATER/xDAI LP (split into 2 additions of 400,000)

Target Reserve Ratio: 50%

Max adjustment: 10%

hiveWATER garden covenant: hiveWATER Covenant - HackMD

A Gnosis Safe of active contributors will handle the initial creation and custody of LP tokens. When the Gardens framework is eventually capable of handling multi-token Common Pools, LP tokens can then be moved into the Common Pool. The DAO can also choose to create separate Gardens to hold LP tokens as well.

100% of the DAO’s hiveWATER/HNY LP tokens will be used to support the Abstain Proposal in the Garden as a governance “slow start” measure.

Proposal Rationale

Many DAOs today battle systemic issues that render them unviable. Common ones include:

- Governance attacks

- Voter apathy

- Attention scarcity

- Vote buying

- Community polarization

- Majority rule

- Dependence on favorable market conditions

In response to these issues, many DAOs are doing away with the concept of a liquid governance token altogether, a move that significantly limits the governance capabilities of a DAO and effectively cuts the legs off of the technology’s greatest potential for change.

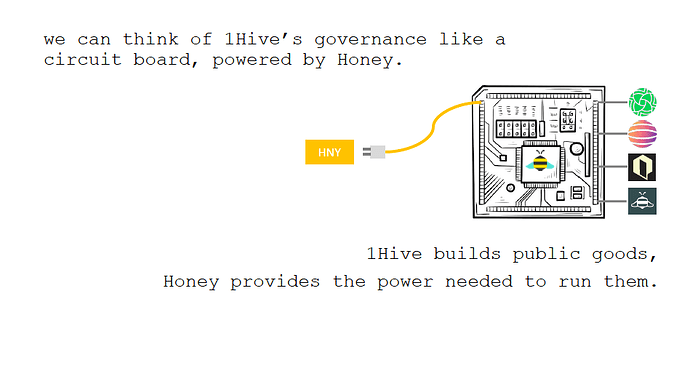

1Hive is ahead of the curve on many of these issues. 1Hive anticipated the systemic issues above and has mitigated a lot of them through a thoughtfully constructed governance framework that combines a Celeste-enforced Covenant, Conviction Voting, Tao Voting, and Dynamic token issuance. 1Hive and its governance token Honey have now been sustainably funding web3 public goods for over 2 years, with over $12 million in value locked in its open source tools that include Honeyswap, Agave, Gardens, Celeste, and Quests. All of this with $0 of investment from private venture capital.

And yet, 1Hive is still struggling to stay afloat.

In spite of all these accomplishments, 1Hive still faces other systemic issues common for DAOs with liquid governance tokens, including:

- Growing and maintaining liquidity for the governance token, Honey

- Establishing a narrative for Honey’s viability as a store of value

- Distributing Honey in a way that accurately reflects where value is being created (needed for the DAO to function and evolve successfully)

How does hiveWATER solve these problems?

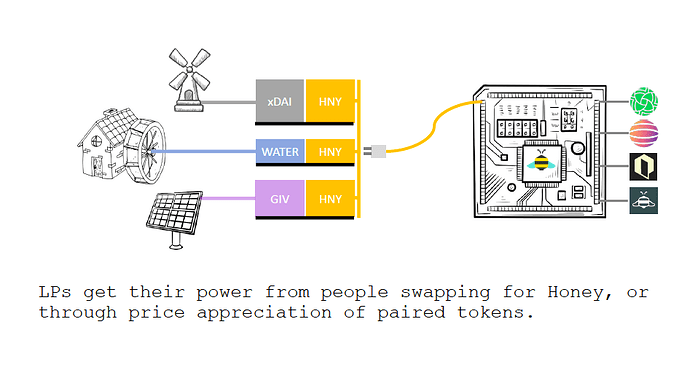

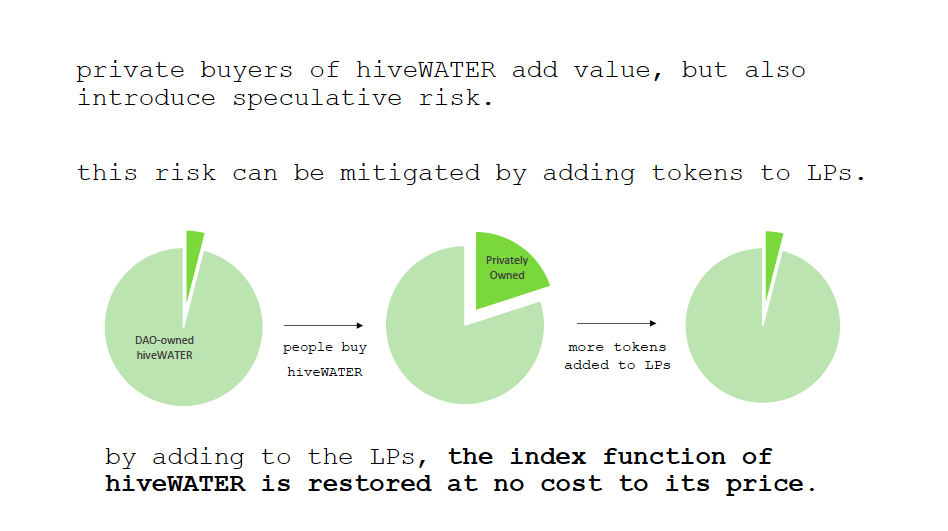

hiveWATER is based on the economic model of the Water token, which provides sustainable liquidity for 7 different tokens on Gnosis Chain. 100% of Water’s circulating supply is minted into liquidity pools, which allows it to function as a self-balancing index of its paired tokens. Participating tokens get permanent liquidity at the cost of only their own token, plus exposure to a diverse set of tokens with aligned interests.

Where Water falls short is its inability to provide liquidity with important assets like stablecoins, ETH, and BTC, which are widely considered the most durable cryptocurrency assets today. These are important investment assets and also the endpoints for value entering and exiting the Honey economy.

hiveWATER applies the tokenomic model of WATER to the individual DAO of 1Hive.

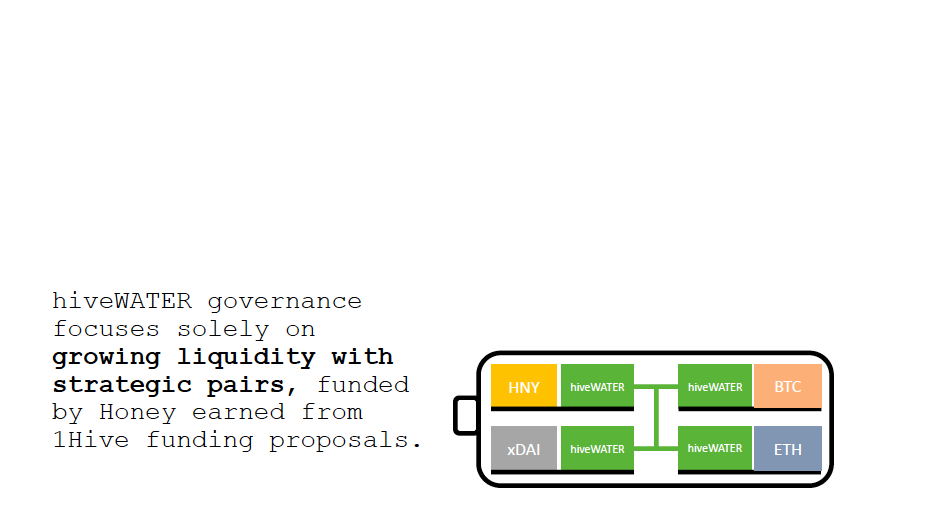

Separating the token from the Honey token allows the hiveWATER DAO to focus its efforts solely on growing the financial value of hiveWATER, which supports the price of the Honey token without affecting Honey’s utility as the governance token for 1Hive.

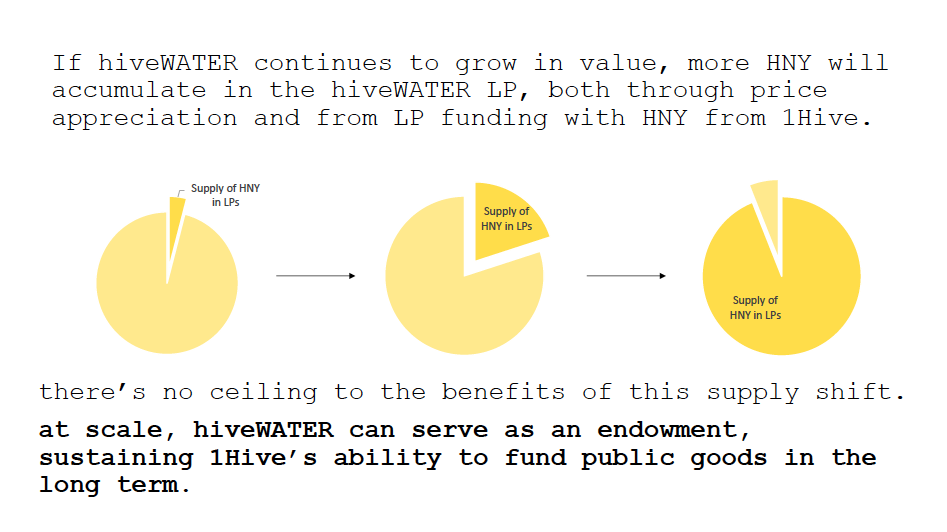

At scale, hiveWATER could provide permanently sustainable funding for 1Hive by serving as the primary store of value for the Honey token. For this to work, the vast majority of Honey’s token supply would be in hiveWATER LPs and other shared liquidity pools. When inflation of the Honey token can cover 1Hive’s expenses and still be less than the average growth in value of shared liquidity (both from paired asset growth and retail purchases of hiveWATER tokens), Honey can then permanently fund public goods. Still, hiveWATER provides plenty of value for 1Hive well before this happens.

More on the governance setup.

The interests of hiveWATER and 1Hive are aligned by using the hiveWATER/HNY LP token as the governance token for the hiveWATER garden. The restriction of hiveWATER’s use to LPs is enforced by the Covenant + Celeste, and executed by a Gnosis Safe of hiveWATER contributors. Eventually an automated setup could be built that embeds these restrictions in the smart contracts, preventing the need for a multisig.

Funding for hiveWATER will come primarily from funding proposals for HNY from the 1Hive garden. This HNY can then be used to convert to other assets using whatever method 1Hive finds suitable. 1Hive can also choose to fund hiveWATER with other tokens it owns.

Expected duration or delivery date (if applicable):

4 weeks following the funding of this proposal.

Team Information (For Funding Proposals)

Here is the team of signers for the hiveWATER multisig that will create and hold the LP positions:

Skills and previous experience in related or similar work:

What are some of your skills or related experience that might help inform HNY holders about your ability to execute on your proposal

Funding Information (For Funding Proposals)

Amount of HNY requested:

800 HNY

Ethereum address where funds shall be transferred:

0xd43268ED85ea21eeF26cb25592798F0cB853BDb9

(4 of 11 Gnosis Safe)

More detailed description of how funds will be handled and used:

See proposal description. Gnosis Safe will be used to create and hold LPs, and the hiveWATER garden will manage all issuance and distribution of the hiveWATER token.

- the token is minted and garden is live, but no liquidity has been added for the token yet.

- the token is minted and garden is live, but no liquidity has been added for the token yet. hiveWater is live

hiveWater is live