So over the past week or so Honeyswap Liquidity incentives have come on line.

Farming ON! YAY!

So what happened.

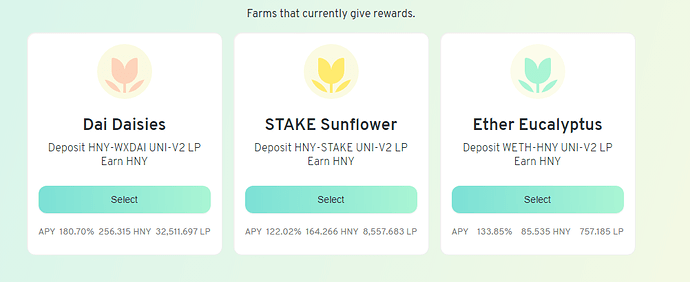

- 300 HNY was added as payout on HNY-wxDAI LP

- 200 HNY added to HNY-STAKE LP

- 100 HNY added to HNY-WETH LP

HNY-wxDAI liquidity - https://info.honeyswap.org/pair/0x4505b262dc053998c10685dc5f9098af8ae5c8ad

HNY price was around 900-1000 Liquidity was in the 1M range. Within 3 days we got about 3x liquidity.

4 days after as return dropped and HNY price varied but overall liquidity stayed about the same at 3M.

Volume overall spiked up to match a end of september volume peak of about 2M traded and then quickly backed off to about .5M/day volume before was trending down into the .15-.2M/day with some spikes. So loosely speaking we have bumped liquidity here and trading volumes about the same amount. We will need more data to see how well this holds.

HNY-STAKE liquidity - https://info.honeyswap.org/pair/0x298c7326a6e4a6108b88520f285c7dc89403347d

Here we got about the same 3x in liquidity (in the past day this has bumped to another .5M in past day). 500K going to 1.5M in the first 3 days. and now to 2.0M

VOlume here had a similar spike at the end of september and hit a low before LP farming in the 20-40K range before climbing again. Where we now have maybe 200K/day average trading. Highest spike was 500K. Previous peak 228K. Volume is up perhaps 10x so HNY-STAKE generally showing some increased trading interest relative to HNY-wxDAI pair.

HNY-WETH pretty much had no volume or liquidity prior to farming 10K liquidity 1K volume. After farming brought on line. Liquidity grew by 100x to now about 1M this also has stayed pretty much constant after a 3 day increase. Trading volumes spiked to .35M and have tapered off to about 150K daily volume here.

General conclusions:

- HOneyswap liquidity incentives have increased liquidity on the primary HNY pairs by 3x. Where liquidity was the lowest HNY-WETH this increased 100x.

- Trading volumes increased by about the same amount on HNY-wxDAI but seems to have gotten bigger bumps from the lower liquidity pairs (HNY-STAKE, and particularly HNY-WETH) indicating those less liquid markets significantly benefitted from the incentive program.

- The least liquid pair actually benefitted the most HNY-WETH

- Actual fees from volume has gone up by (rough estimate is a factor of 3-4) I am still looking for data but are still somewhat low relative to the value of HNY being thrown as an incentive. Looking at fees (most of which are going to LP providers) we are in the 4-5K/day range and given the 600/30 = 20 HNY per day incentives is exceeding the reward to the system fees by 20x and if we go to .05% (1/6 4-5K is about 600-800xDAI) as profit to 1Hive by about 100x.

- As a value the LP has brought capital and attention to 1Hive,xDAI and Honeyswap. It is clear roughly 5-6M USD has moved into Honeyswap and so far appears to be staying. Returns in the farming are still in the 150% range so the incentive here is quite high. From what I am seeing money is staying in the system.

I looked at other pairs to incentivize and I consider the following to be key candidates…

-

STAKE-wxDAI this has 160K liquidity with 31K volume. Not generating a lot of fees but since STAKE is used to validate the xDAI network I think this is a key pair to consider tossing even 50HNY for a month at to see how the markets respond.

-

xMOON-xDAI this pair is consistently doing volume even if the liquidity is 1/2 the STAKE pair and a possible one to incentivize. I would suggest 20-25HNY for a month and see how these markets respond

-

WETH-wxDAI is another pair with really low liquidity that I think should be considered for at least 25-50 HNY because it is a key pair that would help all the other markets. Quite frequently I find my Honeyswap swaps going through multiple pairs to get better prices. Pretty often this is the WETH-wxDAI pair at least for me.

If I was going to pick best rewards here I honestly would go with

- STAKE-wxDAI first with 50 HNY for a month

- 50:50 on WETH-wxDAI or xMOON-xDAI. My personal preference is to kick start the WETH-wxDAI pair because it is one that we really will want some decent liquidity in so that anyone going to WETH or xDAI can use WETH-wxDAI as well as HNY-WETH and HNY-wxDAI. In the loosest sense the WETH-wxDAI pair liquidity will help the HNY-WETH and HNY-wxDAI as well. I might go with 50HNY here as a start as well.

I have looked at HNY-wBTC and think this should be in the list of next targets. We started with three if we do 3 more I’d like to do the above with slightly more conservative rewards. I think we should keep in mind that as liquidity comes in we will want to sustain these rewards to keep liquidity hanging around until Honeyswap bootstraps both liquidity and trading volumes… Right now the returns for the rewards are dominated by a promotional aspect and bringing money into the ecosystem vs. an actual monetary reward.

Right now given the staying power of liquidity in the primary 3 pairs I see no reason to consider changing those rewards. I do see a good reason to pick a few other key pairs to bootstrap liquidity and the above 3 are good candidates.

These are the types of reports i like to see!

These are the types of reports i like to see!  Who needs SEDAR when we have

Who needs SEDAR when we have  , I think it would also add a lot to the community to have them.

, I think it would also add a lot to the community to have them.