That original proposal was removed it is mentioned a few times on this thread, I left that info in the original post, fixed up ty.

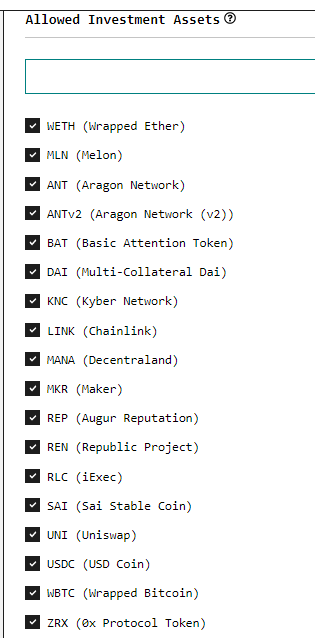

I agree our liquidity isn’t here which makes it pretty tough for this to work. Here is the list of tokens they support, pretty small list imo:

BAT.

If only I could get my BAT off Brave, lol.

In regards to the “liquidity” once the bridge contracts have been audited we will see lots and lots more coins being bridged over to xDAI and when that happens we will see a mass exodus to xdai, so i do not think that is a issue, right now sure but no reason why we can not start building to get ready.

Hahah do they require KYC ?

Yeap If you want to transfer bat tokens from brave browser to one of the wallets they setup you need to go through kyc process.

Yeah, and somehow my KYC is good enough for Coinbase but not Uphold.

They just launched V2 yesterday, called Enzyme. There are many more tokens available right now, including synthetic ones that offer you shorting.

Respect man! After going through all the write-up, I’ll say you truly want to give the community the true value of it.

Can you expand on why you think this? I know xdai are releasing the reverse omnibridge soon and I see discussion about it being audited. But this alone I don’t think will bring much liquidity, is more than the reverse omnibridge being Audited? An alternative more secure/decentralised bridge perhaps?

So, somehow I totally missed this proposal when it was made. Seems like a really neat idea. I also would be in support of a proposal to payout for the work done, assuming there is some revenue tie in with the HNY token.

I think the HNY token is likely better for this than the agave token, mostly for the same reason that Agave was created rather than just using HNY: separation based on risks.

IMO Agave would make a great candidate as a token for general purpose insurance across xdai (and maybe across other L2s) since this is going to be the risk and fee model of the token on Agave anyway, so it seems like a natural extension.

hey @scottie, haven’t heard from you in awhile. Hopefully we didn’t scare you away. I think we should talk about roughly how long we expect this to take, and we can get a proposal up for it I believe. Even the first proposal you made was pretty modest so I’m surprised there was push back against it. More projects like this are exactly what we need on xdai to bring more engagement to the sidechain.

Even if not very many people use it, having another defi building block that can be integrated and iterated on is great!