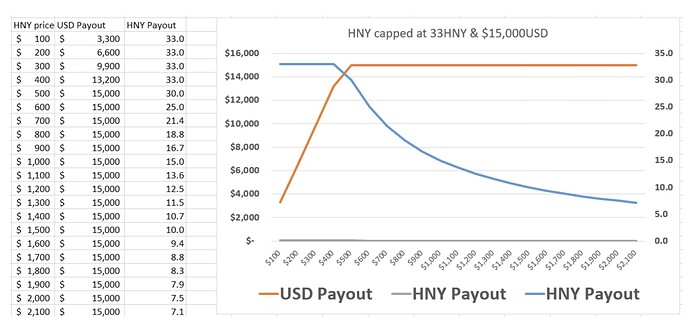

If we go with 33HNY and $15k ($454 is the intersect)

what does intersect mean? Sorry dumb question.

After looking at some discussions in here I decided to vote for at max 33 HNY, whilst being pegged to 15-20k usd. Distributing 200 HNY a month does seem like a bit too much personally, when compared to other proposals that are asking for funding such as Celeste.

I think it means that at a price of 454$, the distribution of 33 HNY roughly equals the pegged amount we have chosen. For any price under 454$ per HNY, we choose to payout 33 HNY instead of pegging to USD, (as the price is too low), whilst having a price of >454$, meaning that we always hand out the pegged amount of USD.

Alright, I created a new proposal based on 33 HNY / week for 5 weeks:

Please go vote for it if you agree. I will keep the polls open for now still, but this seems to be what the polls are suggesting.

The usd peg is up in the air between $15k and $20k / week rn.

Keep in mind that the pollen DAO reserves the right to change the usd peg as a future decision, but the max HNY value per week is determined based on the funds received through this proposal.

It’s so good to be a part of this community, everyone genuinely doing what they think is best for the DAO. There is no way in hell we won’t succeed. Glad to be a part of this.

Keep in mind how outsiders look at this. It seems like a small group of people are only voting in their best interest (as a chosen few) and not in the best interest of the project. Scarcity drives the price up which in turn attracts attention. Don’t get me wrong I appreciate what people are doing but some of the votes are not in best interest of the project but just seem greedy (salary). Just my two cents.

you’re against higher pollen payouts then?

Is paying people for their work not in the best interest of the project?

Same deal as last time, we are going to do a proposal for 4 weeks at 33 HNY a week, or $15k in HNY, whichever is smaller.

Edit: new proposal: https://1hive.org/#/proposal/96

Same as last time, 4 weeks at 33 HNY a week, or $15k in HNY.

We have increased the usd peg of the payouts to $20k / week, and decreased the maximum hny payout to 30 HNY / week. We still have some funding left, but likely not enough for another week.

I propose 3 weeks of funding at 30 HNY / week. This seems likely to last more than 3 weeks though:

Can it be handled in a different way potentially?

For example, SMC which you claim your HNY reward from. The SMC gives you the option to compensate if your HNY lost value and did not receive the promised amount at point X, but allows you to leave it, basically depositing the amount to handle other compensations, earning interest, if an AMM could handle that. Furthermore, if HNY appreciates in value, you can leave the surplus too, same mechanics apply.

Sorry, I don’t understand, can you explain this more? What is SMC?

One option I really like to this problem is paying out in for example HNY-xdai LPs… the issue with this is that you have an immediate sell pressure which you may not experience otherwise.

Please make new proposals in new threads. You can link to old ones. Burying them deep in old outdated threads really doesn’t ensure clarity.

Just an abbreviation for smart contract. Also it doesn’t even have to hold your HNY it can just take a snapshot, although it should hold the HNY which you deposit. The idea is just HNY staking that is used for compensations for people if they get a HNY reward and the price fluctuates from their promised value. The only problem is writing an AMM that can compensate HNY (so partly from the staked HNY and partly from the common pool) while being able to repay interest to the person that staked it. I will do a proper writeup later, though I am no finance expert so idk if this is viable.

Also it doesn’t even have to be staking for that, it can be staking for anything HNY can be staked for. Or we could lock the surplus HNY and distribute it over time, and only instantly compensate losses.

My point being, pegging it to USD is an ok solution but I believe we have more unique opportunities because we can manipulate easily the flow of our cryptocurrency.

I’ll just write a thread.

Shouldn’t 30 be aligned with 15,000$ in that graph?

How can I see address list those received pollen distribution?

You can see on our discord in pollen channel