Quick Overview

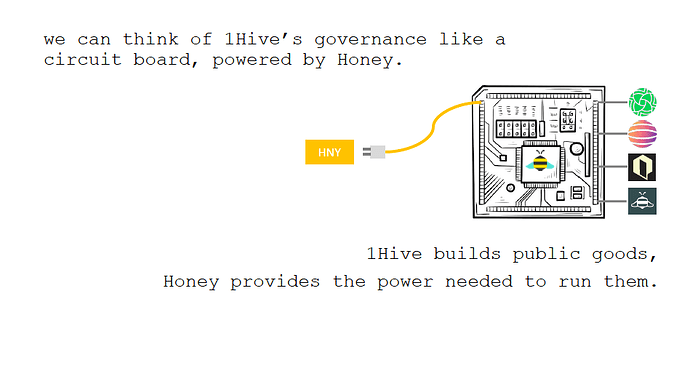

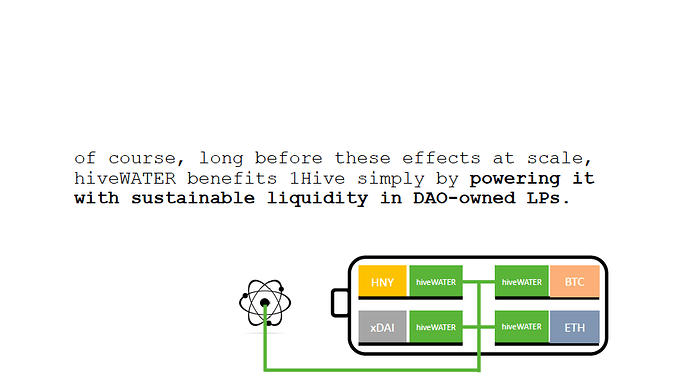

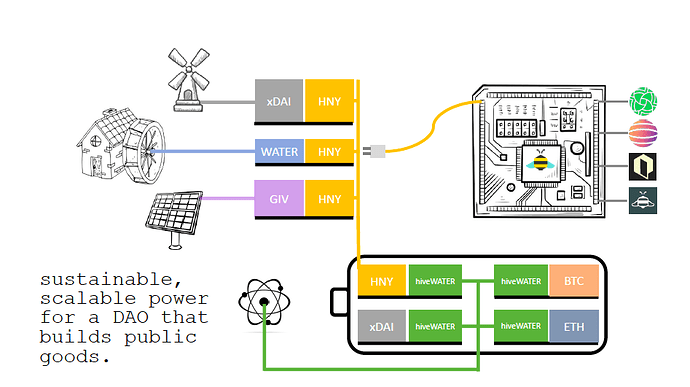

Let’s create a dynamic issuance Garden with the Common Pool token oHNYo, a liquidity token funded by Honey that provides sustainable and scalable liquidity for 1Hive (for visual learners see the PDF).

What is a liquidity token?

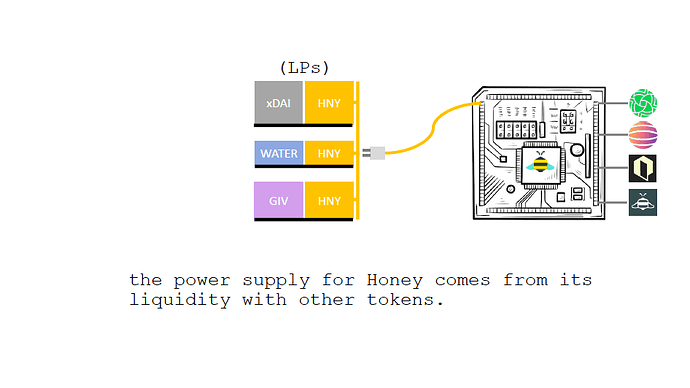

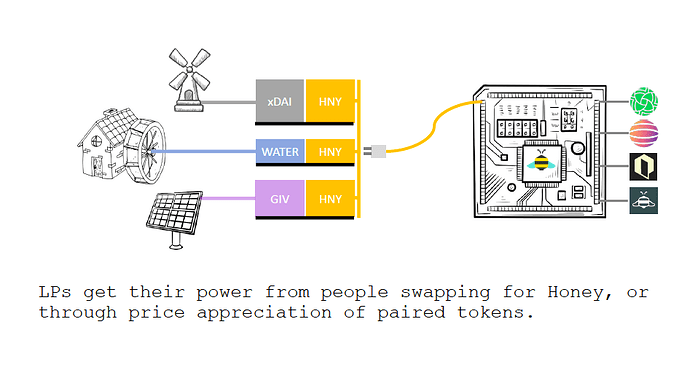

A token with 100% of its circulating supply released into liquidity pools, like the Water token. The token acts as a liquidity proxy, facilitating swaps between its paired tokens.

What are the benefits?

-

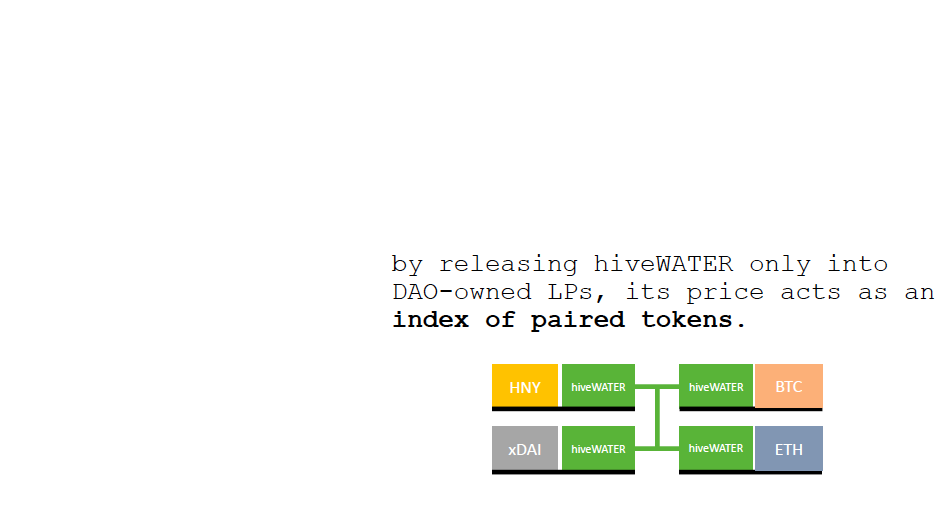

Auto-balancing index of paired tokens

When all of a token’s circulating supply is in LPs, its price is solely a function of the tokens it’s paired with. As paired tokens respond to price changes, the size of each LP grows or shrinks based on their relative value, changing each token’s portion of the total liquidity. In this way a liquidity token works like an auto-balancing index of the tokens it’s paired with. -

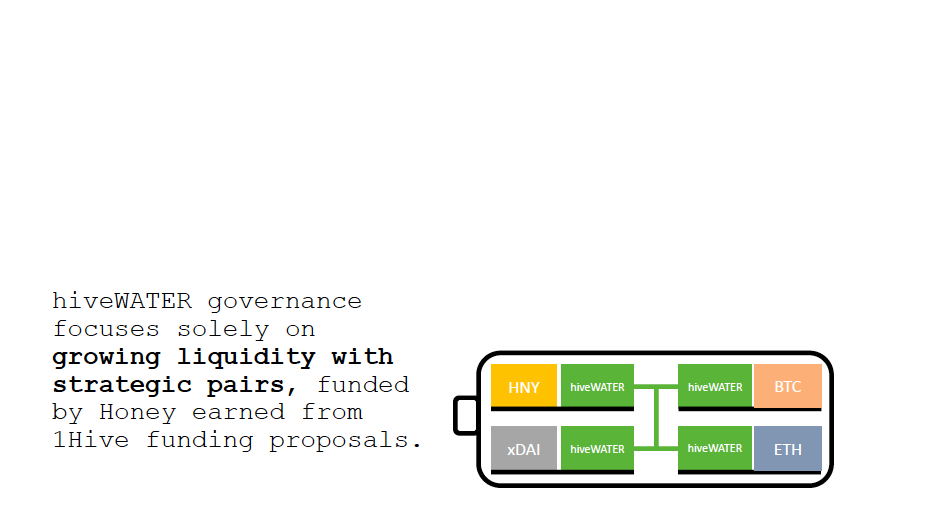

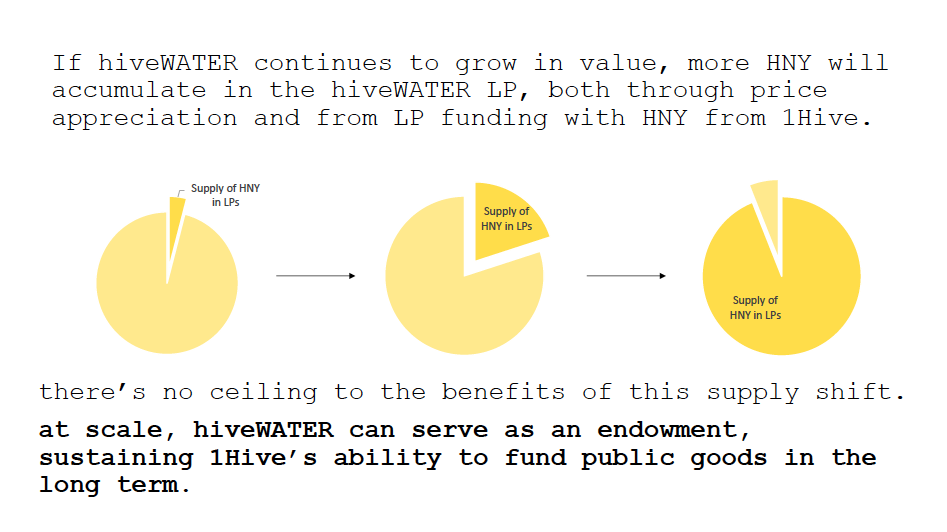

Grow healthy DAO-owned liquidity

A liquidity token also facilitates trades between the paired tokens, a valuable service that’s hard for communities to get for their tokens affordably, sustainably, and scalably. Liquidity tokens can be compared with direct shared liquidity and Bonding Curves in their ability to provide such healthy liquidity. -

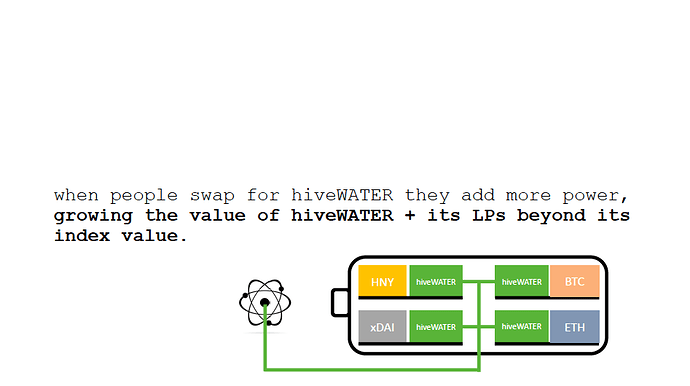

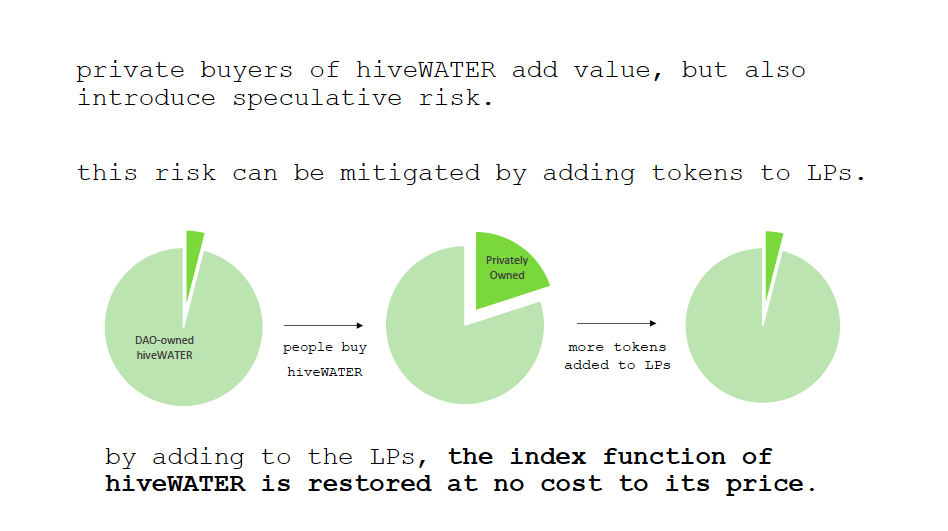

Value brought in by private buyers can be matched by 1Hive.

While a liquidity token is released only into liquidity pools, nothing prevents someone from swapping for these tokens and holding them privately after they’re in an LP. This creates speculative upside, with no corresponding downside at launch since there are no privately owned tokens to sell. Private buyers grow the value of the LPs and paired tokens through price correlation, but introduce speculative downside since those tokens can later be sold. This can be mitigated by 1Hive providing more tokens to the LPs, effectively matching some of the value brought in by private buyers by increasing the portion of liquidity tokens in LPs.

Proposed Structure

- 1Hive provides the initial HNY and xDAI to a multisig that manages the launch of oHNYo.

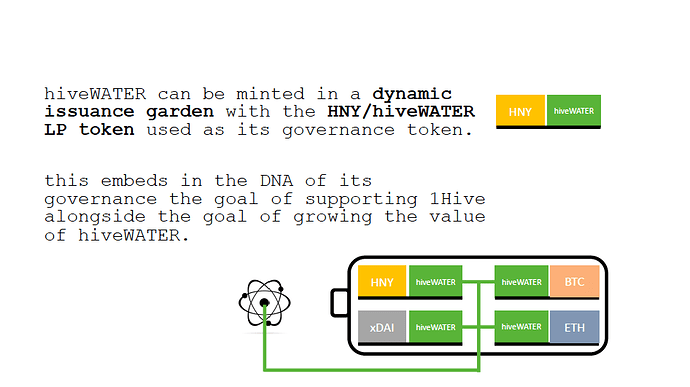

- A Garden is created with the dynamic issuance Common Pool token oHNYo, paired by the multisig into 2 LPs: HNY<>oHNYo and xDAI<>oHNYo. An arbitrary token price of $0.01 is set.

- The governance token for the Garden is the HNY<>oHNYo LP token, and the initial HNY<>oHNYo LP tokens created at launch will be used to support the Abstain Proposal to ensure slow start for governance. To participate in oHNYo governance, you’ll need to buy oHNYo and pair it with HNY.

- Governance of the oHNYo Garden involves:

- Diversification of LPs - target percentages for oHNYo’s LP portfolio

- Target max private ownership % - above this the DAO works to add tokens to LPs

- Acquiring and converting Honey - proving oHNYo’s value to the 1Hive community so that 1Hive continues to provide funding. This will likely need to include strategies for converting Honey to other tokens with minimal sell pressure on Honey (i.e. Hedgey)

- Clear benchmarks for success & failure - If oHNYo doesn’t reach an agreed level of private ownership (say 50% within 1 month), the DAO agrees to disband and send its tokens back to 1Hive. To further incentivize success, the DAO can set aside a portion of the tokens initially provided by 1Hive, and only add those tokens to LPs when that private ownership % is reached.

Proposed Parameters

-

Conviction Voting

- Minimum Conviction: 10%

- Conviction Growth: 4 days

- Spending Limit: 50%

- Rationale: allows for large funding proposals but requires more support and longer staked conviction compared to 1Hive. The DAO should need fewer funding proposals than 1Hive, but likely will need large sums when it is requesting funding.

-

Dynamic Issuance

- (match the existing 1hive parameters)

-

Tao Voting

- (match the existing 1hive parameters)

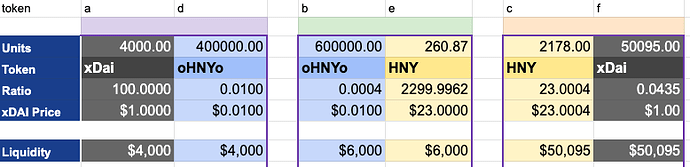

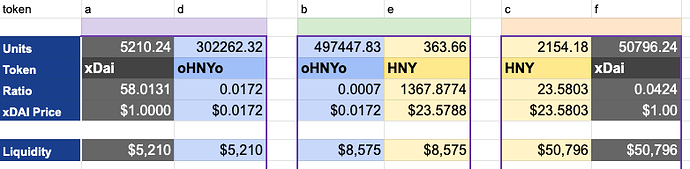

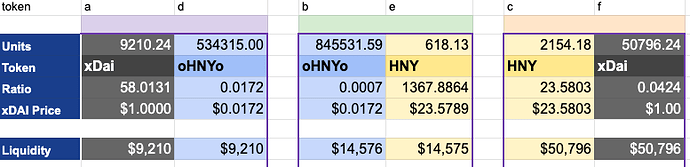

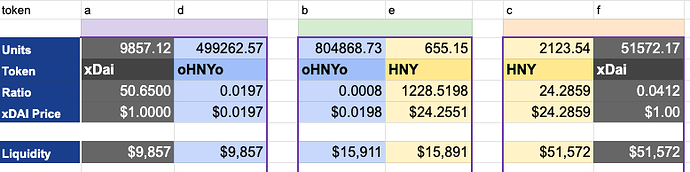

Modeling this 2-token ecosystem

The specifics of the price correlation between oHNYo and the paired assets and the arbitrage opportunities after each trade are important to the economics of the HNY token. The linked spreadsheet below simulates a DEX with 3 liquidity pools:

- xDAI<>oHNYo

- oHNYo<>HNY

- xDAI<>HNY

In the spreadsheet you can make swaps or add liquidity, and an arbitrage calculator will then show you the most profitable swaps you can make in that configuration. The model shows how any trade will affect the token prices and liquidity amounts of each LP when arbitrage is taken into consideration.

Make a copy of this spreadsheet to try it for yourself: