Hey all,

I’m just wondering how hard it would be to setup a system where users could supply a token (which could be approved by the community on a list) and have it matched with HNY in the liquidity pool. The intent of this would be to minimise the mainnet fees associated with bridging a token over and effectively double the liquidity… It should only have a positive impact on the HNY price because there would be an incentive to use HNY as the other token in a pair.

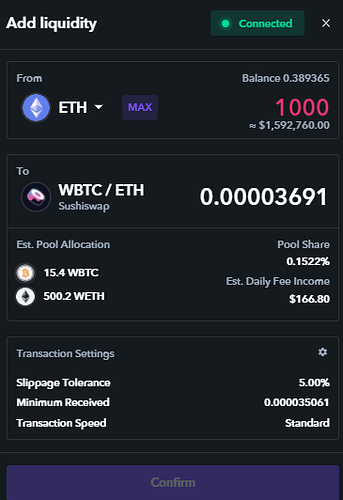

Example: I want to bring stakedao tokens over to xdai and put them into a liquidity pool. I bridge my SDT over the omni bridge (paying the mainnet fees) and then supply them to honeyswap to be matched with HNY. At this point the new HNY is minted and 1hive essentially has an investment in the pair. It does create more HNY, but in most instances I would imagine the user would continue to provide liquidity, so it would not create a sell pressure on HNY.

It does create the problem of 1hive owning a bunch of alt coins, but we could maybe have them setup as an index fund style investment for members to buy? This is why having the community create the list of eligible tokens would be good.

Once a pool has enough liquidity it would not be eligible, because the user can just swap half their tokens for HNY before supplying to the LP without major slippage. It would mainly incentivise users to bring new tokens across the bridge and provide liquidity to honeyswap.