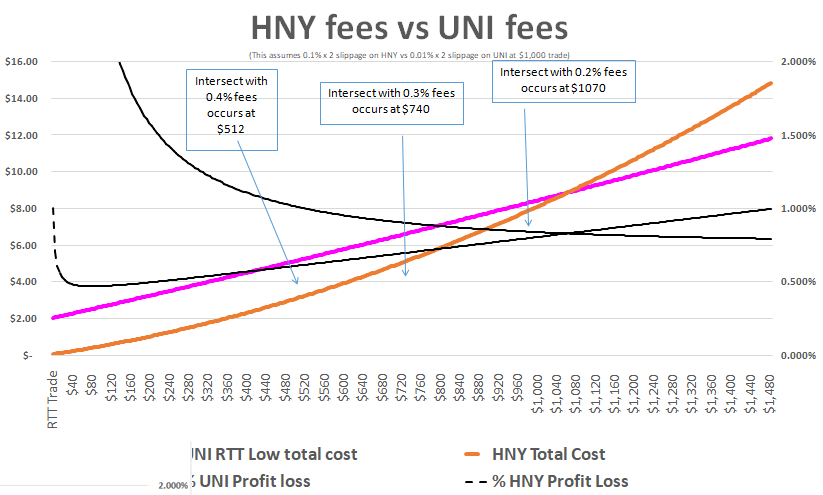

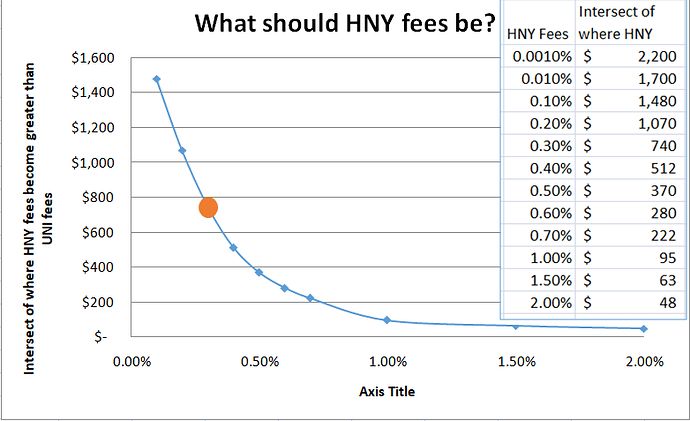

Since honeyswap is a fork of uniswap the fees paid to liquidity providers are set at 0.3% by default. Although the gas fees are much lower on xdai, I think the incentive for moving here isn’t enough yet.

Farming is a great tool to get new investors interested and has been successful. It also creates more sell pressure in these early stages.

I would like to discuss the idea of raising the trading fees to 0.5% for a determined amount of time to incentivise all existing and new pools without giving away free honey for each pair. Save the farming for strictly honey pairs.

I feel this would bring liquidity to honeyswap faster and keep the liquidity here long term. I feel there would be less sell pressure on honey also.

Is this an option?

started” again.

started” again.