aka, An Incomplete Survey of AMM Reward Tokens and What They Can Tell us

Goals: Review the characteristics of farm reward tokens and compare them, specifically with the intent of understanding how COMB stands up to the benchmark set by other farm reward tokens.

Assumptions:

- You are familiar with cryptocurrency

- You are familiar with the xDai and Polygon sidechains

- You have an understanding of automated market makers (AMMs)

- You have an understanding of liquidity provider (LP) token mechanics and LP staking incentive programs (“farms” or “liquidity mining”)

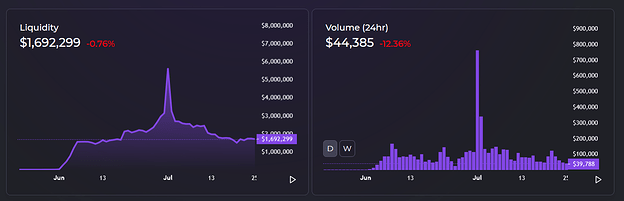

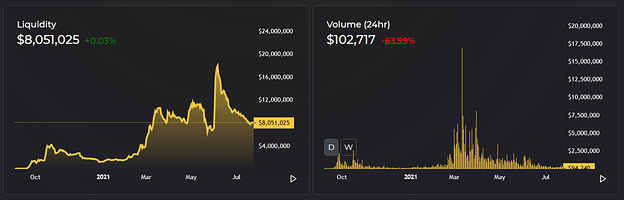

Context: Honeycomb farm rewards for Honeyswap AMM launched on xDai in June 2021, along with Honeyswap on Polygon. Honeycomb farm rewards launched for Honeyswap Polygon in July 2021.

As of early August 2021, I do not believe it would be controversial to state that Honeycomb farm rewards have not achieved their desired effect - which is to attract and retain liquidity in Honeyswap liquidity pools. In the case of both xDai and Polygon, total value locked (TVL) and average weekly swap volume in Honeyswap pools are back to roughly the same levels as before Honeycomb farm launch.

Honeyswap Polygon, taken July 25 2021

Honeyswap xDai, taken July 25, 2021

It’s possible that, without Honeycomb rewards, Honeyswap would have suffered a net loss of TVL, but this counterfactual is hard to assess with any certainty.

(Sidebar: why do we want more TVL? High liquidity pools enable high swap volume with low slippage, which makes the dex attractive to traders. More swap volume drives more revenue for liquidity providers and for 1Hive. Therefore, we want to do what we can to sustainably incentivize both liquidity provision and swap volume.)

As a result of market conditions and COMB tokenomics, farm rewards offered by Honeycomb are currently not very attractive compared to yields offered by other AMMs on similar pairs. It can credibly be argued that the (relatively) low yields offered by Honeycomb is a major contributing factor to capital flight.

Methodology:

I used Dune Analytics, Coingecko and DeFi Pulse to identify the top 5 AMMs (by TVL and swap volume) that offer farming rewards across Ethereum mainnet, xDai, and Polygon. Here is the list:

| DEX | Networks | TVL (maximum) | 24H Swap Volume (July 25, 2021) |

|---|---|---|---|

| Curve | Ethereum, Polygon, xDai | $8B | $143MM |

| Sushiswap | Ethereum, Polygon, xDai | $3B | $113MM |

| Quickswap | Polygon | $1B | $56MM |

| Bancor | Ethereum | $1B | $30MM |

| Balancer | Ethereum, Polygon | $615MM | $21MM |

| Honeyswap* | Polygon, xDai | $8MM | $102K |

I excluded Binance Smart Chain dexes because Binance is predominantly turbo pyramid farms (yes, even Pancakeswap. Especially Pancakeswap. Don’t @ me.) Uniswap doesn’t make the list because Uniswap does not offer farming rewards.

Comparison

| Curve | Sushiswap | Bancor | Balancer | Quickswap | Honeyswap | |

|---|---|---|---|---|---|---|

| Token | CRV | SUSHI | BNT | BAL | QUICK | COMB |

| Issuance | ~3B total supply | 250MM total supply | it’s complicated | 100MM hard cap | 1MM total supply | 1MM total supply per chain |

| Dex Swap Fee | variable (0.030% for 3pool) | 0.3% | variable (0.1%-5.0%) | dynamic | 0.3% | xDai: 0.3% Polygon: 0.15% on WETH pairs 0.3% on all others |

| Protocol Fee | variable (0.015% for 3pool) | 0.05% | it’s complicated | none | 0.05% | xDai: 0.05% Polygon: 0.025% on WETH pairs 0.05% on all other pairs |

| Revenue Stream | 3pool fees are used to purchase 3pool and allocated to veCRV (staking) holders | protocol revenue is used to purchase SUSHI and allocated to xSUSHI (staking) holders | BNT is minted and burned to incentivize LPs and protect against impermanent loss (IL) | none | 0.04% protocol revenue is used to reward Quick staking holders (dQuick)0.01% goes to Quickswap | Protocol swap fee is split between HNY and COMB buyback. Half of COMB buyback is burned. |

| Governance | yes | yes | yes | yes | yes* | no |

| Single-sided staking | yes* effectively available through yearn yveCRV | yes | yes | yes | yes | no |

| Single Reward Token used across chains | yes | yes | n/a | yes | n/a | no |

| Other Utility | locking CRV multiplies CRV farming rewards | - | - | - | - | - |

| Est. Revenue (daily, July 25, 2021) | $16K | $56K | I didn’t want to try and figure this out | $0 | $22K | $500 |

| Token Market Cap (as of July 30, 2021) | $600MM | $1.6B | $800MM | $223MM | $53MM | $200K (xCOMB + pCOMB) |

Key Takeaways

The primary value of a farming reward token is the revenue stream which is directed towards creating value for the token (usually through the Sushiswap MasterChef model of purchasing the token and allocating it to token stakers). As such, it’s reasonable to expect that COMB tokens will be valued at a price which is proportionate to the revenue being directed at them. When considering this aspect, several issues immediately present themselves:

- COMB tokens only receive 50% of protocol fee revenue (the other half is shared with HNY), which immediately discounts the value of holding/staking COMB by half compared to other farm reward tokens

- COMB tokens only receive the benefit of protocol fees collected on their respective chains (xCOMB from Honeyswap xDai, pCOMB from Honeyswap Polygon), which means that the value of COMB is only proportionate to the individual Honeyswap, rather than the combined protocol revenue of all Honeyswap instances

- Halving swap fees for wETH pairs on Honeyswap Polygon creates less revenue for LPs and the pCOMB token, which further reduces the expectation of future revenue

When we move on to consider the other sources of value for farm reward tokens, i.e., incentives for holding them rather than dumping them on the market, we can also see that COMB lacks any of the appealing properties offered by other dexes:

- COMB does not offer any governance rights (even if those voting powers are non-binding, as in the case of SUSHI)

- COMB cannot be staked single-sided, meaning that even if a farmer intends to retain COMB for reinvestment it must either be paired with additional capital, or (as a few 1Hivers are known to do) half of the farm reward is sold on the market (putting sell pressure on the price) to be paired with the remaining half

- COMB does not offer any additional benefits or incentives to hold, such as BNT’s IL protection or CRV’s intensely recursive reward boosting

Conclusion

In light of this analysis, I would like to put forward the following assertions:

In order to reinvigorate the Honeycomb farm program and ultimately accomplish its intended purpose, we must radically overhaul the existing program of COMB rewards to bring its value proposition closer in line with the programs offered by other dexes in the space.

I believe that this reformation is necessary for the long-term success of Honeyswap on xDai, Polygon and, in the future, Arbitrum. Without any changes, I suspect it is very likely that our extant market share and liquidity will eventually be consumed by Sushiswap, Curve, and Quickswap.