Proposal Title: Deepening 1hive’s Investment in Gardens-v2 via Juicebox and Community-Wide Protocol Fee Exemption

Proposal Information

Gardens-v2, the innovative DAO management platform nurtured by 1hive, has launched its next growth phase through a Juicebox financing campaign (Link). This proposal aims to reaffirm 1hive’s commitment to its homegrown project by actively participating in this fundraising effort.

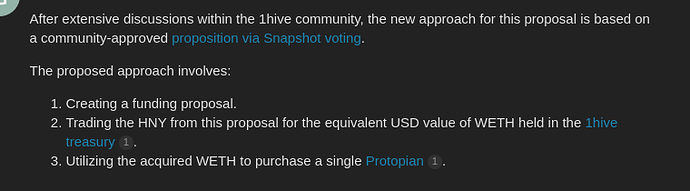

As an incentive and reward for the 1hive community’s continued support, we propose acquiring a special NFT that grants all 1hive members a complete exemption from protocol fees on the Gardens-v2 platform. This unique benefit allows the entire community to directly share in the financial success of the project they helped foster.

Protopian NFT:

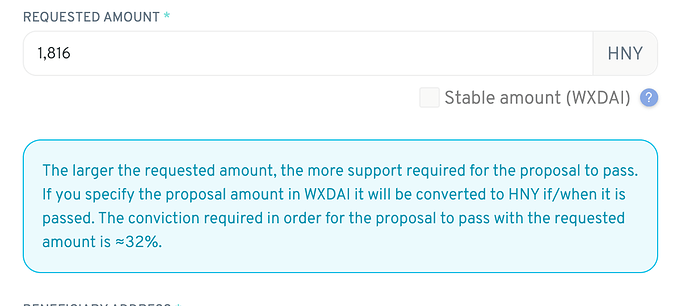

This NFT is unlocked after purchasing a minimum of π (3.1416) ETH worth of Garden’s Juicebox tokens.

Proposal Rationale:

1hive’s participation in the Gardens-v2 Juicebox campaign not only provides crucial funding for the project’s development but also serves as a powerful endorsement within the Web3 ecosystem. This reinforces Gardens-v2’s credibility and demonstrates the DAO’s confidence in its long-term potential.

The community-wide protocol fee exemption NFT is a tangible reward for 1hive members, aligning their interests with the success of Gardens-v2. This model fosters deeper community engagement, strengthens the bond between 1hive and its incubated project, and showcases the power of decentralized collaboration.

For Gardens-v2, this deepened collaboration secures crucial resources through the Juicebox campaign while solidifying the invaluable strategic partnership with 1hive, a community renowned for its innovation and decentralized governance expertise.

Expected duration or delivery date:

The NFT granting protocol fee exemption will be purchased immediately upon the DAO’s decision* to participate in the Juicebox campaign. The positive impact of this investment and community-wide incentive on Gardens-v2’s growth trajectory will be continuous and significant.

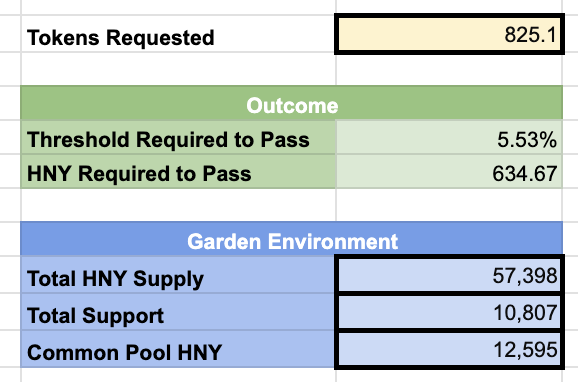

*10% of signaling will be considered as a community decision to appprove this funding operation

Funding Information

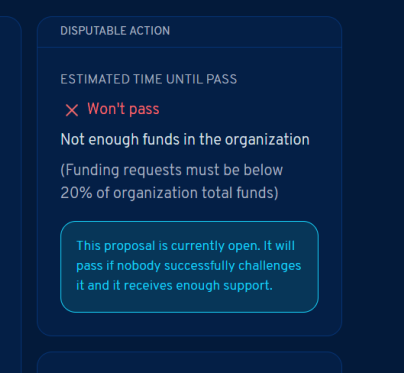

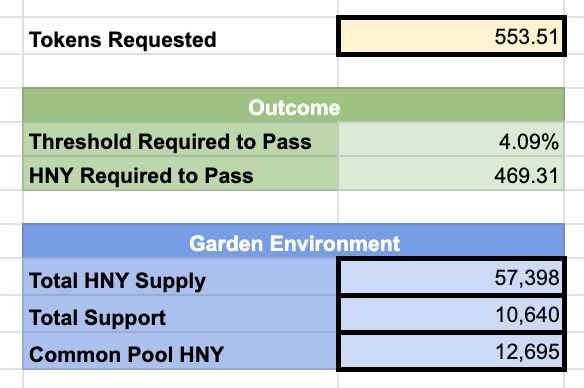

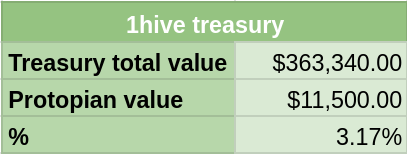

No Honey request from the common pool. Instead we would use the ETH from the 1hive treasury safe.

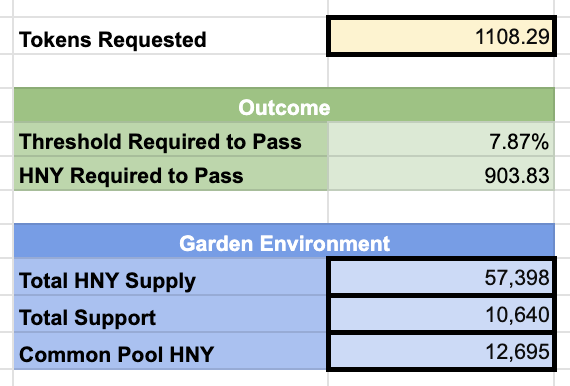

Amount of Juicebox token to be purshased to earn the NFT: 20891 Gardens Juicebox (~11k USD)

Ethereum address where funds shall be transferred: 0xc6c2E9EFB898A42DB4137B07b727b45e0C353d81 (Gnosis 1hive treasury Safe link)

Gardens’s Safe on mainnet: 0x1B8C7f06F537711A7CAf6770051A43B4F3E69A7e

The HNY requested will be swapped within the 1hive treasury for the necessary tokens to participate in the Gardens-v2 Juicebox fundraising campaign at the Protopian NFT tier. The minted NFT will be held by the Garden’s safe in mainnet until transferred to the yet-to-be-determined Council safe of Gardens V2’s 1hive community.

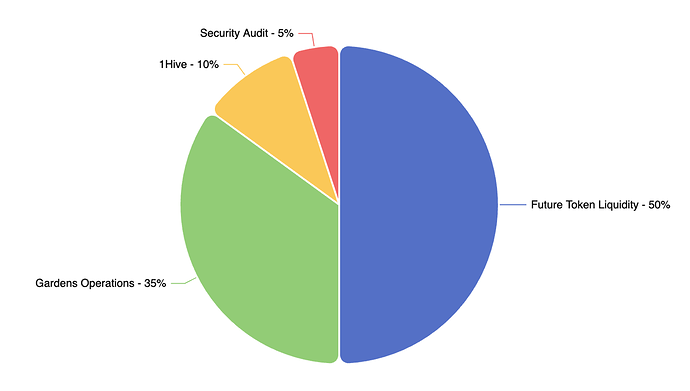

Juicebox campaign funding usage distribution (ETH):

- 10% sent back to 1hive treasury

- 35% sent to ongoing and future Gardens operations

Note that there is also a 30% of juicebox token issued to Gardens that will be distributed for contributors and growth initiative.

Summary of the flow:

[Gnosis] 1hive Treasury Safe:

- Out: 11K USD in wETH bridged to mainnet

[Mainnet] Gardens Safe →

- In: Bridged tokens

- Out: Swap tokens to ETH and fund Gardens project through Juicebox

- In: 20891 Garden’s Juicebox tokens + Protopian NFT