To take ETH PR DAO to the next 100 members, the core team needs to update the token issuance and fine-tune the voting parameters.

We are currently hosting weekly parameter parties to finalize the details.

https://docs.google.com/document/d/1YnSXc5YJhexC5lzj7_El_KyLn9Bl0zdMe_0dpKOcZzo/edit

The current working doc for the parameter. We can use this forum post to share questions and ideas.

What other parameters need to be included and updated?

We currently have

Spending Limit

Minimum Conviction

Conviction Growth

Minimum Approval

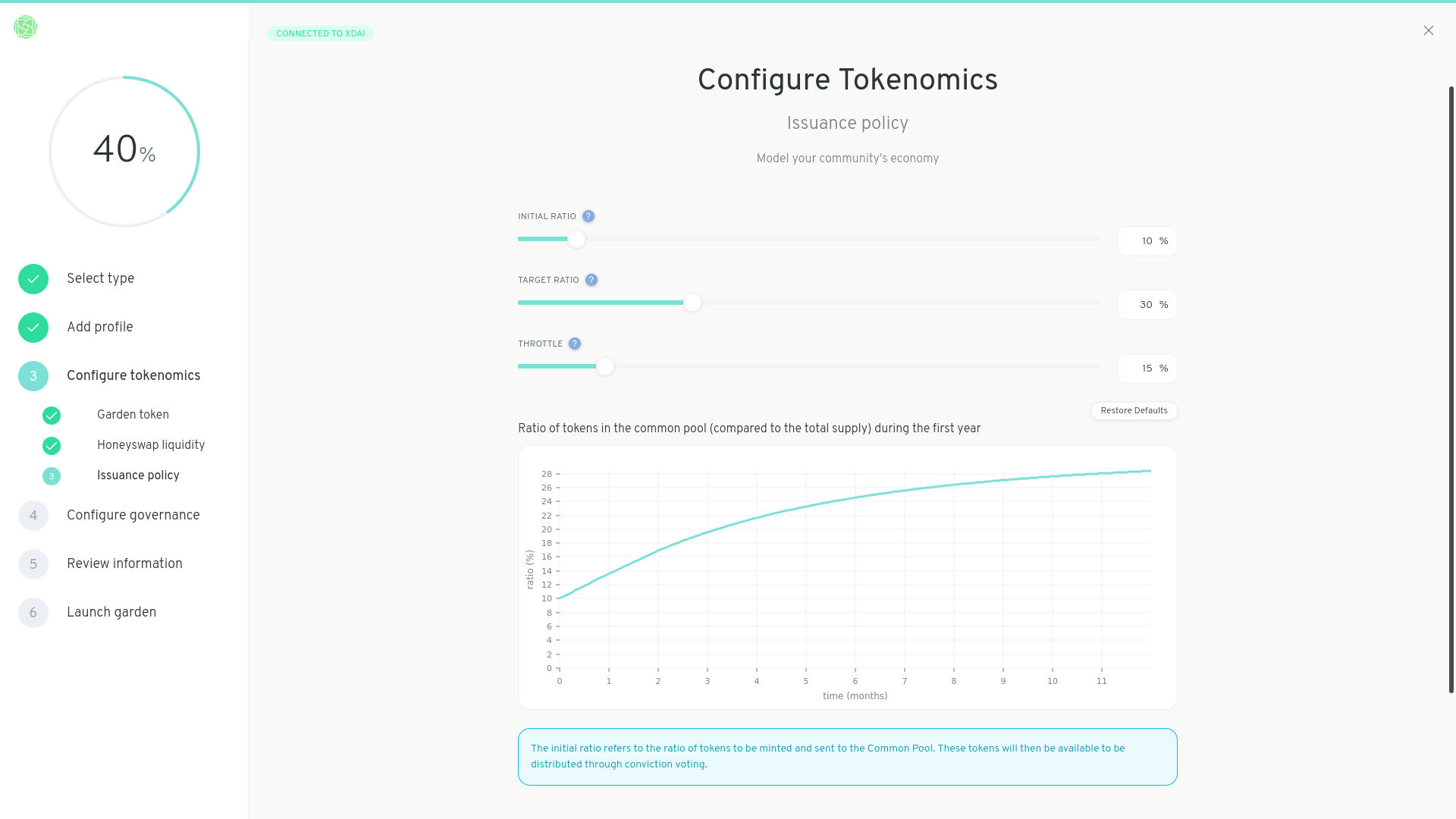

Target Ratio

Furthermore we want to set up a gnosis mutlisig safe that has a treasury to use as liquidity pool collateral.

How do we deploy EVM updates to the token manager?