GUIDE: How to Maximize your pCOMB Rewards

Goal: Enable readers to understand how to maximize the amount of pCOMB they receive from the upcoming release of Honeycomb farming on Polygon

Disclaimers:

- Do your own research - while I have done my best to provide the most up-to-date information, you should not trust that this guide is 100% accurate

- I am not a financial advisor and this is not financial advice. Never risk more than you can afford to lose.

- Staking rewards are NOT free money - they are an incentive to reward liquidity providers who are taking on additional risk by providing their liquidity to a new decentralized exchange (DEX)

Reading time: ~10 min

Assumptions:

- You are familiar with cryptocurrency

- You are familiar with Ethereum, have an Ethereum wallet and wallet browser extension, e.g., Metamask

- You are familiar with decentralized exchanges, Honeyswap and the Honeycomb liquidity mining rewards coming to Honeyswap Polygon

- You understand how to move funds onto the Polygon sidechain

How is pCOMB being distributed?

According to the wiki, the total fixed supply of pCOMB is 1MM. Of that, 5% will be airdropped to the liquidity provider (LP) community on Polygon to incentivize them to provide liquidity on Honeyswap Polygon.

Therefore - 950,000 pCOMB will be distributed to Honeyswap LPs over the course of the next two years as an incentive to stake their LP tokens. Rewards will be higher at the beginning of the farm, and will go down over time until they end completely in 2023.

How will this 950K pCOMB be distributed?

| Pair | Weight | % of Rewards | Total pCOMB Rewarded to Staking LPs, assuming no change*** |

|---|---|---|---|

| wETH-pCOMB | 18 | 45% | 427,500 |

| wETH-USDC | 3 | 7.5% | 71,250 |

| wETH-HNY | 3 | 7.5% | 71,250 |

| wETH-MATIC | 3 | 7.5% | 71,250 |

| wETH-wBTC | 3 | 7.5% | 71,250 |

| wETH-USDT | 2 | 5% | 47,500 |

| wETH-DAI | 2 | 5% | 47,500 |

| wETH-AAVE | 2 | 5% | 47,500 |

| wETH-MUST | 1 | 2.5% | 23,750 |

| wETH-QUICK | 1 | 2.5% | 23,750 |

| wETH-GHST | 1 | 2.5% | 23,750 |

| wETH-LINK | 1 | 2.5% | 23,750 |

***Sidebar: It’s important to note here that the LP pairs which are eligible to receive pCOMB rewards will definitely change over time. This will be done at the discretion of the Tulip swarm, in accordance with the policies being written out now. The keystone pair, i.e., wETH-pCOMB, will always be rewarded for the whole 2 year period to ensure the liquidity of the pCOMB reward token itself. The remaining pairs will be updated based on specified criteria, such as which pairs are generating the most fees for Honeyswap and opportunities to collaborate with other DAOs.

OK, great, so how do I maximize my pCOMB?

In order to maximize the amount of pCOMB you will receive, you should provide liquidity to pools that

A) are receving more pCOMB rewards, and

B) where you will own a higher percentage of the pool’s share.

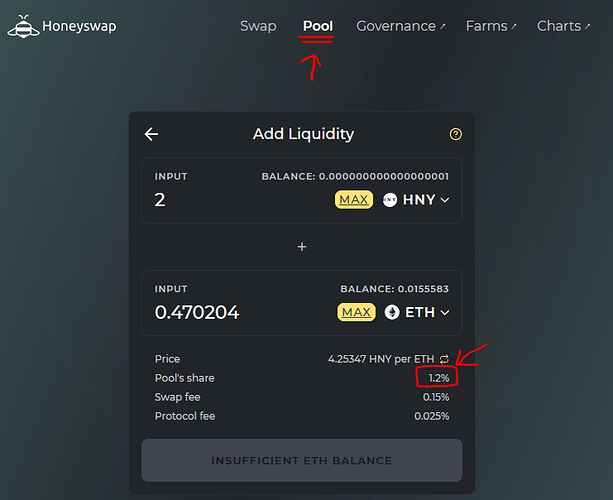

You can check the % of pool’s share that you will receive from the Add Liquidity menu in the Pools section of Honeyswap.

As a result, which pool you should provide liquidity to in order to maximize pCOMB reward will depend on the current liquidity in the pools and will change as LPs add more liquidity into different pools! It will also depend on how much those other LPers have decided to lock their deposits (more on locking below.)

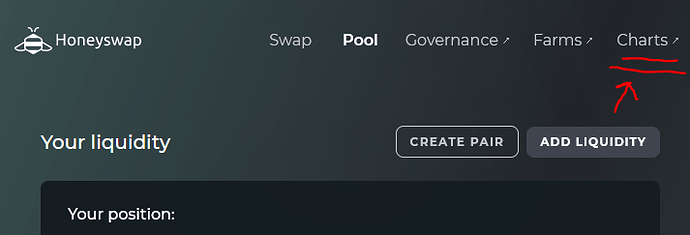

You can check the existing liquidity in pools by going to the Charts link in the Honeyswap interface.

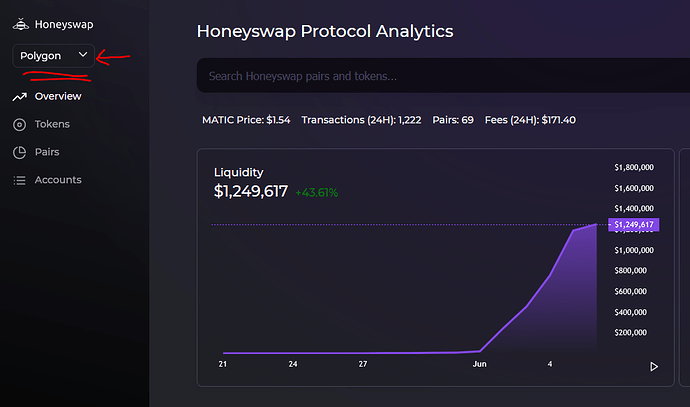

Make sure you pick Polygon from the network picker in the top left of the Charts page.

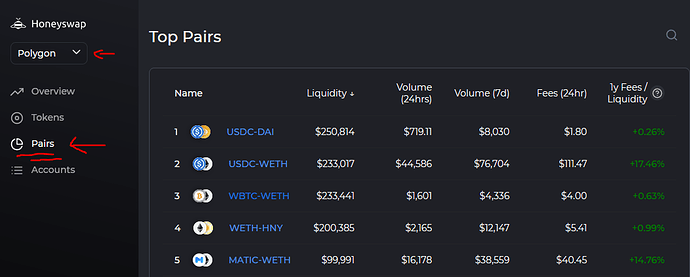

Click on Pairs to view liquidity in all pairs on Honeygon.

I may build out a spreadsheet tool to help with this calculation, but in the meantime, you’ll need to do this math for yourself.

Locking Stakes for Fun & Profit

Another way to optimize your pCOMB yield is to lock your LP stakes for a period of 1 - 120 days. This provides a sliding multiplier of 1.01 - 2x, meaning you will receive up to 2x the pCOMB reward for the same value of tokens staked.

Therefore, you have an opportunity to get more pCOMB for the same amount of tokens this way. The risk, however, is that your tokens are locked for a period of time and cannot be withdrawn. This is particularly important to consider depending on the LP pair being locked because certain pairs may see their pCOMB rewards allocation change over time, especially Discovery and Discretionary pairs. Conversely, the Keystone pair will always have a significant rewards allocation and Performance pairs will retain rewards allocations in proportion to their trading volumes.

Hopefully this guide as been helpful. Please let me know if you have any feedback, suggestions or corrections!