I can’t really make much sense of what this is or what its trying to do.

Hello

DAIX tokens are Elastic in nature!

Some aspects resemble stablecoins, but it is not really a stablecoin ― it’s an Algorithmic Stablecoin!

Price of each DAIX can be manually coerced to equal 1 XDAI by anyone, at any time. This approach introduces the necessary entropy desired by such an asset that its predecessors have lacked, mostly due to inefficiency that comes with unpredictable gas costs (looking at you, Ethereum).

We expect minor volatility in the first few days due to users buying it directly from Honeyswap instead of direct procurement from the contract because such buyers don’t contribute to “gross total liquidity”.

As more people find and learn about Daibase, its vision and it’s built-in interoperability for fellow smart-contracts, more will start directly interacting with our contract for various purposes, chief of which is being used as a lego block in multiple macro-defi ecosytems.

Something very important to mention here is that there will never be any pre-sale, private-sale, initial offering, or any fundraising of that sort. Any liquidity generated by the Daibase Protocol gets locked into the Daibase Protocol for ever. This “part” is often missing in all the former Elastic currencies/assets, and they end up being manipulated by the select few players. Our aim is to level this playing field. Owning a million versus owning a hundred doesn’t make any difference here at Daibase. No special privileges. Bees or whales, rules stay the same.

Sidenote: If you ever find the price of 1 DAIX not equal to 1 XDAI, you can “Hit the BaseCannon” and re-establish equilibrium. Ropsten Testnet version can be tried out free-of-cost right away at our github page : https://daibase.github.io.

Suggestions and feedback is welcome at any of our social mediums!

We recommend asking as many questions as possible. We are building Daibase for the community to use in the decades to come. This is a new concept and we would be more than willing to explain each aspect in detail and how to make DAIX integrations with your smart contracts in a permission-less manner.

Twitter@ : DaiBased

Telegram@ : Daibase

Discord Invite : VU8NHdmYu6

(Or simply click the links in original post above)

Apologies for the inconvenience.

We are a very young community and many of us don’t find Elastic assets easy to understand. We must encourage everyone here to ask more questions, as specific or broad as they could get, without any hesitation. The more the people who understand Algorithmic Stablecoins, the more easier it gets to explain to the remaining!

We hope you found the required information to get started with testing DAIX37 of Ropsten. We tried to give details in our Telegram Channel (Telegram: Contact @DaiBased) and our Discord channel (#events).

Our current version (DAIX40:v0.1.40) has a significant improvement against the old contracts. We recommend using DAIX40 for future interactions and integrations.

Note: Versions older than v0.1.x were named “XD” tokens. DAIX is the name that will be used for all future purposes.

At their core, “Elastic Supply” is a term that is used to describe a changing total supply of the underlying asset. This could be seen as a response to the market conditions (demand versus supply).

Each of these currencies have a “target” that they gravitate towards, establishing the stable equilibrium.

As an example, if the Elastic Currency (E) has a target of 1 Franc (F), and the market price of 1 E is more than 1 Franc, the elastic currency will try to move towards its target (decrease its price) by inflating (printing more E), attempting to eliminate the deficit (lack) of E in the Open-Market. This should theoretically push people to sell off their surplus slowly and cause the price to decrease to 1 Franc.

Similarly, if the demand in the open markets for E is lower, naturally its price would slowly become less than 1 Franc. Our elastic asset resolves this deviation from the target by deflation (burning some E), so that it supply is reduced and adjusts to the lower demand. By doing this, as lesser E is available in the markets and starts becoming scarcer, the price per E starts appreciating, gradually reaching the target of 1 Franc once again.

This very nature of adjusting it’s outstanding supply makes DAIX a truly Elastic Asset, that always reacts to the real-time market forces. The above theory is realized by pushing a special button on the blockchain, which we at Daibase refer to as "hitting the Base Cannon. Calling this special function instantly re-establishes any deviated equilibrium back to the target.

DAIX tokens target the DAI (The Multi-collateral Dai Stablecoin), which hovers about $1 always.

We welcome you and all our 1hive and xDAI community members to ask any queries. It would be our pleasure to quench all of your doubts!

Our testnet version has evolved over 60+ smart contract version iterations during testing period in the past weeks. We will go live on xDAI only when our community desires so in unison. Until then, we will keep improving our design and tokenomics, courtesy of our keen Daibase Community.

We hope to see you soon once again!

Okay thank you for the information, it solved my doubts.

Same. So many buzzwords and I have no idea what the use case for this is

Feels like someone tried to place as many technical terms as possible, regardless of the phrases having a meaning.

Yes, DAIX tokens are a hedge against systemic risk associated with cryptocurrencies. In simple words, when Bitcoin goes down, almost all other coins fall down too.

Since Bitcoin, thousands of new cryptocurrencies have failed to add any diversity to the ecosystem because they follow Bitcoin too closely. Economically, it is as if only one new asset has been introduced because adding more identically-designed cryptocurrencies offers no marginal optionality. This means the volatility of demand of closely-related crypto translates into the price of anything denominated in such a currency—including contracts and debt. For this reason, sudden shocks in demand can destabilize whole ecosystems supported by fixed supply assets. The greater the complexity of an ecosystem built on fixed supply assets, the greater the risk of these cascading failures. In such environments, aggregate volatility cannot be reduced using baskets of assets, like traditional hedge funds and asset managers do.

Daibase Protocol translates this price-volatility into supply-volatility.

It has the ability to fairly and automatically adjust its supply in response to demand, without any need for a bank. It is designed to be the simplest direct solution to the supply inelasticity problem that limits assets like gold and bitcoin.

DAIX tokens revert back to the price of 1 DAI at the press of simple button.

This brings diversity to the ecosystem through a counter-cyclical supply policy that automatically and proportionally adjusts supply across wallets in response to demand, being the simplest direct solution to the supply inelasticity problem that limits assets like gold and bitcoin that have a hard supply.

In the Daibase system, supply changes expand directly to wallets and contract directly from wallets, with no bank, mediator, orchestrator or marketplace in between.

DAIX tokens are not designed to appreciate in value over time. They are designed to follow DAI as closely as possible, re-establishing the equilibrium at every hit of the Base-Cannon, coercing 1 DAIX = 1 DAI.

Elastic assets are a breakthrough concept in Decentralized finance and Daibase attempts to bring algorithmic stablecoins to xDAI blockchain. It is easy to get confused about the underlying mechanics and we are trying to explain as much as required.

Please come over to our Telegram (most active) or Discord (less active) whenever you have a question or face trouble digesting such concepts. We’d be more than happy to help and clarify any topic.

See you soon @ Daibase!

And what does this achieve… what’s the point of daix… a stable coin that’s pegged to the value of another stable coin?

Is there a transaction “tax” ? Or did I misunderstand what I saw on the github?

As stated in our previous replies on this thread:

DAIX tokens are Elastic in nature!

Some aspects resemble stablecoins, but it is not really a stablecoin ― it’s an Algorithmic Stablecoin!

It is NOT PEGGED to anything at all―DAIX are  % uncollateralized.

% uncollateralized.

Algorithmic stablecoins are a totally new sub-class of crypto assets. They are NOT like traditional, discretion-based stablecoins (USDT, BUSD, etc.), that print new money or remove supply at the discretion of their creators.

This special, more monetarily-efficient sub-class manages its own monetary supply by itself, without the needs of Humans green-lighting mint/burns.

This expansion or contraction in DAIX supply happens via a Price Oracle (internal or external), that signals the self-aware Daibase smart contract about its real worth in the real world. Based on this feedback, Daibase Protocol simulates an airdrop or sometimes, a burn, automatically, on its own.

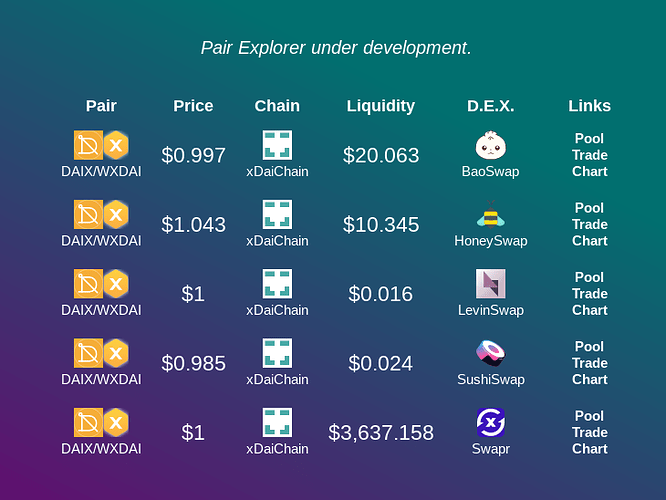

These airdrops (or supply slashing) keep the total supply of DAIX in check with its real-world demand, maintaining the price of 1 DAIX equal to 1 DAI (or here, 1 XDAI), in the open-market (i.e., the AMMs like HoneySwap, Swapr, Levin or BAO).

The point of DAIX is to be an alternate central-bank currency, and not a commodity. As a contrast to Bitcoin, which can act as Both (a Fiat as well as a Commodity), DAIX tokens are designed to be self-stabilizing, maintaing their target as closely as possible.

The USP (Unique Selling Point) of DAIX is that it actually, instead of just hollow promises made by their predecessors (like a few projects mentioned by @project_uwb above), Daibase for real delivers the technology that enables Elastic Assets to be usable by Smart Contracts, and not just in smart contracts.

By virtue of its innovative <interface IXD>, any smart contract can engage in flash-minting DAIX as much as they wish, without violently disturbing its market price that could happen with market-buying something.

Beyond all these core mechanisms, Daibase, as a Protocol, establishes its Reserve, that stands tall as it’s unshakeable, perpetual liquidity, for it’s incoming & outgoing participants.

It also generates it’s own Revenue that is distributed to and utillized by the DaixDAO to further expand its presence.

We heartily invite you to our Telegram to discuss and our Github to test it out! (Make sure you’re on the Ropsten Network before interacting.)

Our xDAI Chain version will roll out very soon. You can follow our twitter to be notified of our releases. We will launch on our next blockchain soon thereafter.

Hello zcq

You’ve understood it right! We do have a transaction tax of 1%, which will be reduced to 0.1% once Daibase is more active.

Why do we need it?

It serves as Protocol Revenue, that is distributed to farmers and used for expanding Daibase to new users.

It’s use is dictated by the DaixDAO. Most common uses are to incentivize Liquidity in a DAIX HoneySwap pair by farming in the HoneyComb

We don’t have a “team fund / dev tokens / vested vc / promotional tokens / management shares” etc. other allocations for DAIX as this is totally a completely community driven project.

The total supply of DAIX will be 1 DAIX at launch, and it will be locked into liquidity at HoneySwap along with 1 XDAI donated by the team. There will be no way to mint/create DAIX tokens without paying the Smart Contract (see our shopping  section).

section).

Wait—There’s more!

On top of all this, we have our “KingMaker

” smart contract, which holds open-auctions directly on-chain for a treasure

.

(Visit the “

Heir to DaiX” section to learn more…)

Heir to DaiX” section to learn more…)

Anyone who wishes to instead receive the plush 1% tax for themselves can sacrifice their coins (XDAI in case of xDAI Chain) in an open-bidding process, where the highest bidder gets the title of “The Chosen One”, earning the right to drain the treasure (i.e., entire Protocol Revenue) into their own address.

We will be releasing on the xDAI Chain on Friday, 16th April at 12pm UTC (Friday morning America, Friday Evening Asia).

Our community will be active at Telegram: Contact @Daibase.

Come over, we’ll be waiting!

Well can you explain the difference between elastic and dynamic supply which described here?(Dynamic Honey Supply Policy Proposal)

Hello @Jsh976

This is indeed an interesting comparison. Let’s give it a try!

Honey vs Daibase : Issuance Policy

All that follows comes from our limited knowledge about Honey and 1hive. It is not supposed to be taken at its face value given the age of this account. Elderbees are welcome and encouraged to rectify the wrong assertions made by the newbee.

Key differences:

-

HNY issuance affects other holders by reducing their share in total honey’s total supply and market cap. Assuming market valuation of Honey at whole is unchanged, this implies loss in Honey price, and hence, impoverishing the the regular ‘hodler’ further.

DAIX issuance does reduce other holder’s share in its market cap, but it does not result in reduction of market cap or price.

Instead, whenever DAIX are issued, 1 XDAI gets locked into the protocol for every 1 DAIX that’s issued to the minter, increasing the market cap. Worth of other’s tokens stay unaltered. -

HNY is issued on a ‘good-faith’ basis. It is assumed the payouts from the ‘common pool’ will bring value to the whole ecosystem in future. Their is no ‘hard guarantee’ that such issuance will increase the price of Honey.

Daibase Protocol runs on ‘hard backing’. Each DAIX issued results in 1 DAI (in a general, chain-agnostic sense) getting locked up as Protocol Controlled Value (PCV), that strengthens the entire Protocol. This is in stark contrast to faith-based models that rely on ‘good-actors’ to create value.

-

Honey is burned from the common-pool when there’s too much HNY in there, guided by a ‘target ratio’. This burning reduces Honey from circulation, but it does not explicitly equate to HNY price going up. It just burns Honey’s market cap.

When DAIX are burned by the Daibase Protocol, market capitalization remains constant, unchanged. In DAIX tokenomics, burning translates directly, without laziness or gotchas, into straightforward price increase per DAIX token.

Adaptive nature & Reactance:

Both of them are built for different purposes.

Both of them have their own unique characteristics and similarities.

In terms or Dynamics and Elasticity, Honey is more Plastic than DAIX.

Notably,

-

HNY reacts slowly to market. Allows prices to fall abruptly in face of volatility.

DAIX reacts quickly to market in real-time. Doesn’t allow price dips.

-

Honey is scarce and does not expand freely as demand grows.

It instead becomes more expensive to acquire when more people want to use it.DAIX adapts its supply to its demand proactively, allowing each and everyone to participate at a fair and equal cost even during demand shocks or other volatile phases.

Ecosystem incentives

-

1Hive relies on minting new Honey to pay for its contributors, developers and other extra resource consumption, that are vetted duly by the Governance procedures. This has a dilution effect on other Honey holders.

Daibase Protocol does not need to mint new tokens to pay for these things. Requisite funds are automatically generated by the Protocol itself based on the usage of the Protocol.

-

New Honey is minted to cause flow* of value in the community governed DAO and paid to good-actors.

DAIX paid to good-actors effectively originates from the flow of value itself within the Protocol. Printing money or inflation is not required.

Deflationary economic models:

-

Deflation in Honey comes (sometimes) from the burning of protocol generated revenues. For example, the one-sixth of 0.3% fees (0.05%) of HoneySwap goes into the “common-pool”, sent through by the “honey-maker” (the famous Sushi-Maker) smart contract, whenever the amount inside the common-pool goes above the “target ratio”, which is determined by a bunch of sophisticated variables measuring “potential productivity” and “effectiveness”. This model is significantly better when compared to the old models where each year 60% more HNY tokens were minted every block for the benefit of the active DAO contributors. The new model helps restrict unnecessary minting when there’s ample Honey in the common pool.

In Daibase Protocol, supply contractions come from a real-time Price Oracle that tells the Protocol about its instantaneous demand/supply numbers, which in turn acts upon this feedback to “dynamically” adjust the supply of outstanding DAIX tokens.

-

During contraction of Honey supply, no holder is effectively participating in rejuvenation directly with their Honey at stake.

Nor does it stimulate, let alone inhibit, other Honey emissions (for example, Faucets, Farms, etc.).In case of Daibase, each and every holder, be it the Protocol Reserves itself, the farms, vaults or even a small holder of fractional DAIX — all participate with equal vigour in their full capacity to bring back the order and re-establish the {{1 DAIX === 1 DAI}} equilibrium.

Daibase strives to serve as a (de-)Central Bank. It issues DAIX as its “Cash Currency”, that’s regulated by all of its holder’s evenly. It is issued upon locking up of real-world and valuable collateral as its “(de-) Central Bank Reserves”, which is a form of DAI on most blockchains, and XDAI, on the xDAI Chain. On the other hand, Honey aspires to be a “Currency” or “Valuable Stock”, depending on the context of its use. HNY is thought to be appreciative in nature, and not to be used for day-to-day purposes generally due to its price instability. It is more scarce and difficult to obtain.

Once again, all this comes from our limited knowledge about Honey and 1hive. Elderbees are welcome and encouraged to rectify the wrong assertions made by the newbee.

Both of them are built for different purposes.

Both of them have their own unique characteristics and similarities.

We’re still on the Ropsten Testnet, where we will introduce our new Farms this Weekend!

Make sure to join our telegram or discord for our open-public testing sessions.

Make sure to join our telegram or discord for our open-public testing sessions.

Current version of Daibase is v0.1.47(d) deployed at 0xe35C667f869DcA393e16141b66a2d83Fa892f320 on Ropsten (C=3;N=3), and anyone can mint DAIX147 tokens from the shopping section of our GitHub dApp as described in our previous reply. Please feel free to ask any questions and clarify all your doubts! Our project is from a new dimension of De-Fi―Algorithmic Stablecoins, and we are here to answer all users who express their confusions.

Is there any server for this project? I would like to know more about it. Thanks.

Send a link or something.

hello there, @Elartistazo

sorry for the delay, hope we aren’t too late !

sorry for the delay, hope we aren’t too late !

Here are our top links:

- Daibase Discord Server

- Twitter handle

- News Channel & updates

- Our telegram group (most active)

- Daibase.org (stable/official website)

- Nightly Dapp for testers/devs

- DAIX on BlockScout (Daibase xDAI v0.1.61)

- DAIX on Etherscan (Daibase Ropsten v0.1.61)

- A subset of the most F.A.Q.s

A lot transpired in the last week―

We launched the first version of DAIX on xDAI Chain  and our T.V.L. numbers are steadily growing!

and our T.V.L. numbers are steadily growing!

We finished our first phase successfully where we burned  the entire Liquidity (currently valued at $3,267.831) tokens upon each successful mint of DAIX tokens!

the entire Liquidity (currently valued at $3,267.831) tokens upon each successful mint of DAIX tokens!

There’s a lot more to come, for we’re just 3 days young on the xDai Chain. Next big event is going to be the I.D.O. (Initial DEX Offering) of our Governance token: DAOX!

It is scheduled to debut with $4096 worth of locked  liquidity for its full circulating supply (2021 DAOX) in the coming days. Beyond this, DAOX can only be earned by farming

liquidity for its full circulating supply (2021 DAOX) in the coming days. Beyond this, DAOX can only be earned by farming  and participating actively in our various on-chain events.

and participating actively in our various on-chain events.

Please note that the max. total supply of DAOX is 21000 exactly. It undergoes a super-slow (read:sustainable/realistic) emission of 0.01% to 0.021% per day, meaning our reserve’s ecosystem incentives run for a minimum of 31 to 65 years! And on top of this, we will have more sources of revenue, thanks to our innovative "KingMaker

" smart contract(s)!

Like always, feel free to ask as many questions that come to your mind — we’re always glad to answer.

Good luck, SATO was supposed to be algorithmic stable coin with rebasing, however is not stable went from $1 to $0.06 cents lol. By burning liquidity locked forever means people are forced to have DAIX tokens and can’t change back - so if it goes below the $1 stablecoin value then they lose money.

I still don’t understand the use case for why someone would use DAIX, instead of just swapping tokens for XDAI which is already a secure stablecoin?

OH damn it those are GOOD news, thanks you. Nop you are not late, it is never late to know a new project.

Thanks for your good wishes, cryptoclip!

Answers to all of these questions exist in this thread alone, and we don’t have to to look anywhere else luckily.

Let’s run through them once again, because many people would have the same doubts, since Elastic Assets are widely misunderstood and presented in a warped perspective to con unsuspecting people.

Here we go!

(pardon me for the details)

There is something called a “rebase lag” / “dampening factor” in these widely cloned (Note: DAIX is not a ‘fork’.) rebasing projects. It’s purpose is to apparently “smoothen out” any supply fluctuations.

All this is necessary on ETH, because sending rebasing transactions costs big money since ETH is 4000x300 (1.2 million) times costlier than xDAI right now. It doesn’t make sense on Ethereum to transact rebasing functions every block, so these other projects introduce a superficial “lag” / “damp” the inflection.

Daibase on xDAI is as close to ideal Elastic money as possible. We rebase on-demand. Click the button, pay $0.000028 tx fee, and 1 DAIX becomes equal to 1 XDAI right away. Totally opposite to these YAM/AMPL forks who need to wait dozens of hours and days to adjust to the real-life markets. Those old-tech fake-promse projects even impose a “rebase window” condition—that is, if you don’t base it within that 5-10 minute window, supply adjustments don’t happen, and investors continue to suffer the unpegginess.

We don’t do such restrictive stuff at Daibase. You want the peg === you get the peg : as simple as that.

Burning liquidity shows our commitment to this Project. We might as well have pocketed it, used for “dev”, “infra costs”, (lol) etc., but burning it instills confidence in users that in whatever the events be, people always wield the ability to sell out their DAIX back for XDAI. It will be more cute if we agree to call it rug-proofing  instead.

instead.

This is just the tip of our commitment iceberg. Daibase Protocol has a concept called “Protocol Controlled Value (PCV)”, wherein the Protocol itself re-balances liquidity permanent liquidity among the various pools. (Note: This Liquidity can only be moved around but not be withdrawn.)

Going to the deeper basis of our iceberg, you’ll discover that this PCV actually is owned by the holders of DAIX, proportional to their DAIX holdings! (Spoiler: We market DAIX as uncollateralized, but it is actually collateralized in reality.)

This is one among the many other innovations our project makes, and we call this aspect implicit collateralization. When there’s consensus between the holders of DAOX (Our governance token, forming the DaixDAO), they can vote in to “Dissolve the DAIX”. When this dissolution happens:

- The PCV is redeemed for DAI+DAIX

- The DAIX part is burned

- All other DAIX is counted (snapshot) & burned

- All DAIX holders are handed out DAI in proportion to their DAIX holdings.

By now, you might be able to see how we achieve our ever-increasing market-cap floor. People who mint & dump are actually helping the Protocol get overcollateralized.

This is counter-intuitive. But when you consider the fact that DAIX does not have a “pre-supply” or “pre-mint” or “pre-sale” or “private-allocation” or … you get it… , you will see how this is sustainable.

It is sustainable because there’s zero sell-pressure. Nobody who mints DAIX wants to sell DAIX. They mint DAIX to benefit from its features and perks, and not to make $1 = $2. This is a stablecoin, after all.

Did we mention that

Did we mention that  % of the money used to mint DAIX gets forever locked into liquidity? Well, you know this now.

% of the money used to mint DAIX gets forever locked into liquidity? Well, you know this now.

Holding DAIX has a lot of use-cases, but let us just focus on the perks here:

- DAIX transactions generate a small tax, that goes into the Protocol Revenues. This fund, as voted by the DaixDAO, gets used to incentivize the ecosystem―a.k.a. Farming, Staking and auto-compounding Vaults, besides other niche De-Fi yield generation mechanisms.

- The above incentives do not dilute shares, instead they concentrate them into the hands of holders and active participants.

- When the KingMaker is enabled, instead of earning DAIX, users get to earn any other asset, or even simple XDAI, as voted in by the DaixDAO. (Note: The KingMaker basiaclly generates XDAI as Protocol Revenue. The DaixDAO can decide to buy something else with this money and potentially help the other token’s community as well. A Quick-Example: This coming week, we are likely to market buy STAKE tokens to help revive the price of STAKE.)

Now, a short glimpse into what the “use-case” for DAIX is:

Even though a stablecoin, DAIX can be volatile temporarily. As with any other asset class, when demand is increased and supply remains still, the asset tends to appreciate in value. This could happen when someone, instead of minting DAIX, goes shopping at the DEX.

Highly Discouraged!

Always “mint” DAIX.

Never ‘buy DAIX’ at an AMM\DEX!

To mint DAIX, send a small amount of XDAI to0x4Ef1d9A329a0CB0658156aFF55c406cC4393A987with Gas Limit of 500000 (500k). Try with 0.001 XDAI if you just want to test this first

This could be a side-effect / benefit of exposing yourself to DAIX. It’s like market buying USDT to pump it to $1.01. We can try, but it’s bound to revert to $1. Other people would simply “mint DAIX” at $1 each and sell it to earn a profit from this arbitrage.

These concept are widely known as Cash Reserve Ratio and Sovereign Debt of a Central Bank (Throwback: Daibase Protocol– a [De-]Central Bank), i.e, the difference and proportions between Circulating Supply of DAIX and the Total Value Locked (into Liquidity). As of now, it stands at about $100, which means that the outstanding holders of the roughly 2000 DAIX have an unrealized/notional gain of $100, which is about 0.05 per DAIX, or 5% in profits.

What about… if… people… dump this?

Good question.

Even if 1900 of the 2000 DAIX sells out, the holders of the remaining 100 won’t be at a loss.

Why?

Because, The P.C.V. backs the Daibase Protocol.

So, when people dump DAIX, holders benefit and when people pump DAIX, holders benefit…as well.

This is the reason behind our “First-of-its-Kind

” and Purely Elastic tagline.

(Note: There’s a ton of use-cases for DAIX because it allows for “flash-minting” directly from any smart-contract too, and owing to its innovative interface IXD, smart contracts can use it to further execute more arbitrary logic on their mints, like the 14 examples we mention in our whitegoldpaper, or maybe something even more innovative.

Again, this is counter-intuitive, but facts are facts.

Feel free to ask more questions, and we will happily answer!

We’re building Daibase ( slowly but steadily

slowly but steadily  ) for the future of our mutual

) for the future of our mutual  Defi Revolution … and not sure why, but we chose xDAI Chain as the first of our supported Chains (maybe the 1hive telegram was too warm and welcoming

Defi Revolution … and not sure why, but we chose xDAI Chain as the first of our supported Chains (maybe the 1hive telegram was too warm and welcoming  ).

).

‒ Chef

( :

Thanks for very detailed and thorough explanation, this gives me the information I was looking for to make my mind up. I hope the project is a success for you

Mate… that was a detailed explanation and the time you must have spent to put it together shows your commitment. I have been in and out of your discord but was never really able to test out the dapp interface. I think this has now got me really interested. It looks like you have a really good grasp on elastic supply tokens and what their use cases are. Could i suggest that you may be do like a podcast or presentation in your discord for your users on educating them on DAIX but also elastic tokens in general and what your vision is? Would be great to learn, and would suggest if you could record it so that it could be used as an educational video/audio content. Cheers.