Really excited to have xComb and the farms launched and in the wild. The initial pairs were chosen by the Tulip swarm in order to get things rolling, however, the intention is for the allocation of farming rewards to be adjusted over time in order to curate the liquidity that’s available on the platform and attract volume to the exchange.

Currently the ability to adjust pairs and allocation points is held by a multisig of Tulip members. This is a privilege that can be revoked or adjusted via 1Hive decision votes if desired. By giving discretion over this function to the Tulip swarm we hope to be able to be more agile and strategic with pairs and allocations and is also in line with 1hive’s general governance philosophy of reducing the frequency and need for discrete decision votes where possible.

So how will the Tulip swarm manage allocation points and pairs? Thats something we are are still working on and would like to use this thread to propose, discuss, and gather input on policy choices.

Allocation Points System

The farms work on an allocation points system, which means that each block rewards are distributed proportionally to farmers based on the allocation points that have been assigned to each deposit token. Say we have two deposit tokens that have been registered (say ABC and XYZ), if both ABC and XYZ each have 1 allocation point, each would receive 50% of the rewards per block. If instead ABC had 9 allocation points, and XYZ had 1, ABC would get 90% of the rewards and XYZ only 10%.

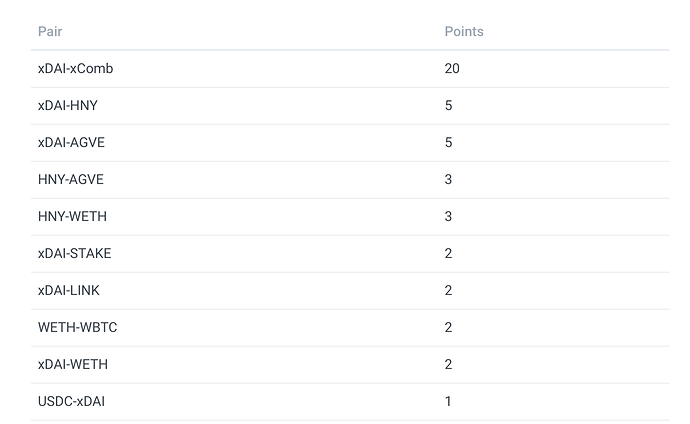

The current allocation points distribution can be found on the wiki, which we will keep updated, but at the time of writing the distribution looks like this:

There are currently 45 allocation points assigned, so the xDai-xComb pair at 20 points is getting ~45% of the rewards, and 4x the amount of reward as the next highest pair. This pair is really important for the farms to work which is why it is weighted so highly, people who are providing liquidity on that pair are helping to establish and stabilize the market for the reward token.

As we add additional pairs and adjust allocation points, we need to think about the relative impact on the existing pairs. Adding an additional point will decrease the relative share of all other pairs, and in an extreme case adding a lot of points could effectively dilute the rewards of all other pairs two nearly zero.

The allocation points system at its core is quite flexible, but because of that there is a pretty large space for considering policies for managing these points.

Allocation Points Policy Considerations

Personally I think the following considerations are really important when considering potential policy for adjusting allocation points.

Predictability is important, if the allocation points are constantly changing it liquidity providers will be discouraged from participating and will almost certainly avoid locking their liquidity for extended periods of time… Imagine you are farming and you lock your deposit for 4 months to get a 2x multiplier, and the next day the points get adjusted decreasing the relative proportion of rewards on the pair you are locked into significantly? In order to avoid this we need adopt policies that make changes in allocation points predictable and stable enough for LPs to comfortably participate in the farms.

Curation is important, because the fundamental goal of the farms is to attract liquidity in pairs that users want to actively trade on. Liquidity for liquidity’s sake doesn’t necessarily translate into volume, and without volume we don’t get fees, and without fees we aren’t supporting a positive value feedback loop. We can approach curation in different ways, and I think think this will likely be the where the bulk of discussion on this topic happens.

A Policy Example

In order to kick of discussion and gather input, its helpful to describe a potential policy that the tulip multisig could use to manage allocation points. A policy doesn’t need to be written in code and can depend on subjectivity and discretion, but it should be specific enough so that its clear how pairs would be added/removed and how allocation points would be likely to change over time.

For example, this seems like a relatively simple policy we could document and adopt:

First we would break the total allocation into categories, each category would have a fixed number of allocation points to distribute to pairs, and may have a different policy for how to manage redistribution of those points over time.

30 points for Keystone pair - the main pair for the reward token (eg xDai-xComb) having a section specifically for this pair so that it would always get at least 30% of rewards.

30 points for Strategic pairs - long term strategic selections (eg the existing pairs other than xComb-xDai would fall under this category), allocation points in this category would discretionary, but the rate of redistribution would be limited to 5 points per month, so the rate of change would be quite gradual.

30 points for Performance pairs - pairs picked based primarily on volume metrics encouraging communities to funnel trading activity to honeyswap in order to compete for additional LP incentives for their tokens.

10 points Discovery pairs- tokens could apply to be incentivized as part of the discovery allocation and be evaluated based on their merits, rewards would last for limited time (eg 4-6 months) and be limited to a specific number of active pairs at a time each token would only be eligible for discovery once so that discovery pairs remain fresh.

lol

lol