Public Good: “A public good is a good that is both non-excludable and non-rivalrous. This means that individuals cannot be effectively excluded from its use, and use by one individual does not reduce its availability to others.” So the most common example of a public good is national defense. Individuals within a nation cannot be excluded from this. The public good is not HNY, but instead, the ecosystem. Regardless of whether one wants to participate, we cannot exclude someone from the ecosystem and more specifically, from the faucet. Honestly does not matter whether we’d categorize the ecosystem as a public good… the point the was being made was that individuals–for, against, or indifferent to the cause–have access to the ecosystem and faucet, regardless of their contributions… Do you agree?

This leads to the next point regarding the free rider problem:

Free rider problem: “The burden on a shared resource that is created by its use or overuse by people who aren’t paying their fair share for it or aren’t paying anything at all.” – The shared resource is the ecosystem and faucet. Let’s take the faucet. Regardless of your contribution to the faucet, if you register, then you receive the same amount as any one else. The free rider problem applied to this would state that there will be individuals who exploit the faucet, sell their HNY and not contribute to the ecosystem because it is there. Do you agree that there are likely individuals who receive HNY without any intention to contribute to the ecosystem?

This leads to my next point regarding money:

Money: “The characteristics of money are durability, portability, divisibility, uniformity, limited supply, acceptability.” Money should also be a store-of-value.

Do not confuse money with currency, which is not a store of value. HNY holds all those characteristics. You could buy other cryptocurrency with HNY. Regardless of our mission with HNY, it has these properties and in turn, is a form of money. Regardless of whether you agree with that, hopefully you agree with the notion that it has value. The very notion of value creates hierarchies. ‘Good’ versus ‘Bad’ money, or crypto, or project, or what ever you want to call it is valid for this situation entirely. No one has unlimited resources, which implies that people are deciding what they will keep versus sell, and buy versus not buy. Do you agree that people (EVERYONE) wants something that will retain value?

Bitcoin=Money=Asset

Stocks are arguably money and money (not currency) is arguably an asset… Take Bitcoin… Hardest money known to man; hardest asset known to man. Calling something money does not mean that it will facilitate transactions; instead, it could facilitate transactions. I could buy things with shares of TSLA if I really wanted to. I wouldn’t, given what it would take, but I could trade partial shares with an agreeing party… This is all irrelevant. Given HNY properties, its ability to facilitate transactions will not diminish.

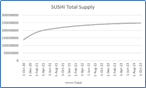

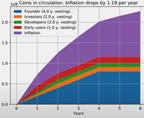

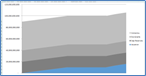

The same functions of dynamic issuance can be ascertained under a max supply cap. The only difference is that value is distributed with respect to proportion of remaining common pool as opposed to the quantity of the pool. Moreover, indefinite inflation and maximum supply are not mutually exclusive. Many assets in this world have a maximum supply, but indefinite inflation. Take gold for instance, which inflates year to year at a decreasing rate… We need increasing supply at a decreasing rate such that the total supply tends towards a value. I agree with:

Lastly, let’s consider the risk-return. Worst case scenario with too low a max supply, we back a new crypto with the value of HNY to meet our needs. Worst case scenario without a max supply, our holdings are worth nothing and majority of participants in this ecosystem leave. Who’s taking these losses well?

BNB

BNB  SNX

SNX KNC

KNC  BAND

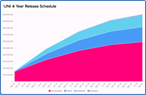

BAND UNI

UNI  Pickle

Pickle  SUSHI

SUSHI  CRV

CRV CRO

CRO