If you’re not familiar with Spending Limit / Max Ratio / Beta, read this post first.

Spending Limit has also been called Max Ratio/Beta, but I’m using “Spending Limit” in this post.

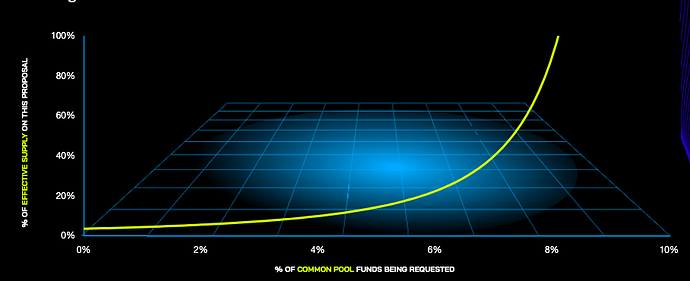

Currently the Spending Limit at 1Hive is set to 10%, which makes it prohibitively difficult to pass a proposal starting at around 8% of the Common Pool requested (~$20k at the current price of HNY). At that funding amount, 62% of all active HNY would need to support a funding proposal for it to pass.

Using the TEC Config tool, we can see the full spread of support needed for proposals to pass with the current parameters, based on the % of Common Pool requested with the current Conviction Voting (CV) parameters.

Current CV parameters

- Spending Limit = 10%

- Minimum Conviction = 3.25% < as of this Tao Vote

- Conviction Growth = 2 days

I’m going to try to cover everything that we should expect to happen if we double the Spending Limit without changing the other CV parameters, effectively doubling the amount of HNY that can be spent in a funding proposal:

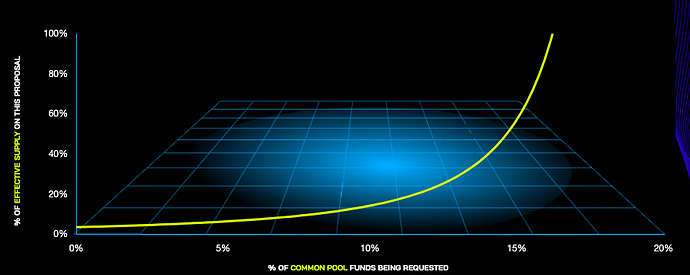

CV parameters after doubling the Spending Limit

- Spending Limit = 20%

- Minimum Conviction = 3.25%

- Conviction Growth = 2 days

First lets define things NOT affected by this change:

- Ability to pass small proposals. Minimum Conviction stays at 3.25% - smaller proposals are relatively unaffected, up to ~2-3% of Common Pool requested.

- Time needed for a proposal to pass. Conviction Growth stays at 2 days, so the staking time needed for a proposal to pass is unaffected.

^ these are objective, however there a couple other subjective things that also should NOT be affected by increasing Spending Limit, when you consider the culture of 1Hive and proposal precedence:

-

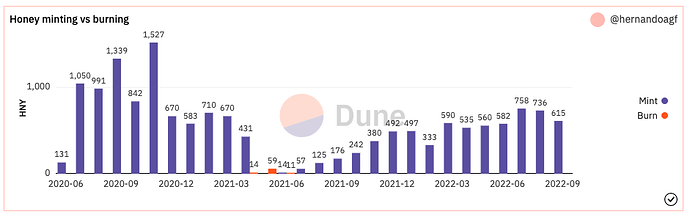

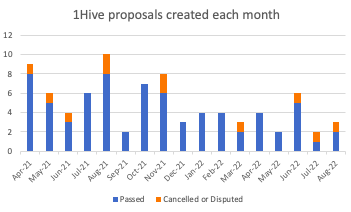

Number of funding proposals created. 1Hive’s Swarms have generally adapted to the decrease in USD Spending Limit (caused by the dropping price of $HNY) by cutting working group expenses, either by lowering the amount of work done or by docking pay for contributors. There has been a decrease in # of proposals over the last year, but this is primarily because of the decreasing price of $HNY and overall crypto market drop, which has lowered participation at 1Hive. Feel free to disagree here, but I don’t see any reason a higher Spending Limit would bring more people, interest, and participation to 1Hive.

-

Number of funding proposals that pass. Most proposals at 1Hive pass, because most proposals at 1Hive come from known members in the community and are talked about in Discord and in the forum before they reach the Honey Pot. Before proposals are created they are either adapted to community sentiment or dropped, and part of the proposal creation process is requesting an amount of HNY that is realistic to pass. All this means that very few proposals that are created fail to get funded. We can see both of these effects in the proposals created and passed at 1Hive:

Things we can expect to change from increasing the Spending Limit.

- Larger funding proposals are easier to pass.

This is the 1 objective change that increasing Spending Limit causes. Subjectively, this should have several effects on the 1Hive economy, which will happen in this order:

-

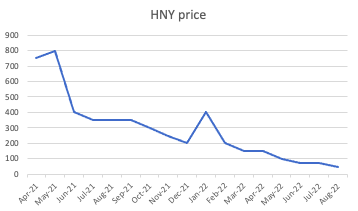

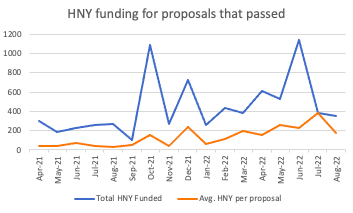

The average amount of HNY requested in a proposal will jump up. Already, the avg. amount of HNY requested per proposal has increased 4x over the last year - far outpacing the increase of the balance of HNY in the Common Pool. This is because of the decreasing price of HNY, causing Swarms to ask for more HNY in proposals to cover their expenses. Recent proposals affected by the Spending Limit (1Hive Harvest Season 1, Quests add’l work proposal) show that the Spending Limit is affecting the amount of HNY being requested:

-

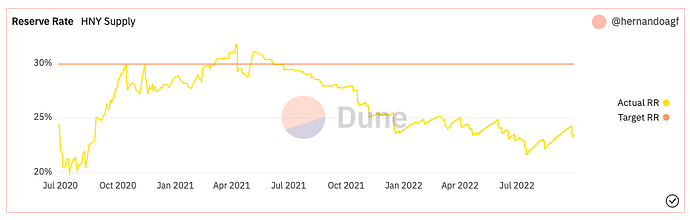

The Current Ratio of the Common Pool balance will decrease. Already the Current Ratio has been decreasing because more HNY is being funded from the Common Pool. With no change in number of proposals passing, and more HNY being requested per proposal due to the Spending Limit increase, the Current Ratio should continue to drop. Link to Honey DI on Dune Analytics.

-

The rate of HNY Inflation will Increase. A lower current ratio means the rate of HNY minting into the Common Pool will increase, based on the issuance formula for HNY:

error = (1 - current_ratio / target_ratio) / seconds_per_year

The extent to which these effects happen will depend on the price of Honey. If $HNY keeps getting cheaper, the avg. HNY requested per proposal will keep going up and these effects will be greater. If $HNY gets more expensive, proposals won’t need as much HNY and the effects will be dampened since less proposals will be affected by a Spending Limit increase.

So, why increase the Spending Limit?

There are 2 key reasons that I believe a spending limit increase will help the 1Hive economy:

-

Honey isn’t flowing quickly enough to currently active contributors. The initial launch of 1Hive hasn’t generated much value growth that Honey is capturing. Current active contributors are essentially bootstrapping the DAO, and Honey distribution through inflation should reflect that.

-

1Hive’s ability to fund work in an economic downturn is a competitive advantage, thanks to Dynamic Issuance. 1Hive didn’t do a great job of diversifying its treasury when the price of $HNY was healthier, which was a big mistake in hindsight. However, 1Hive has still managed to stay productive while its token price has plunged because the Dynamic Issuance policy is sophisticated enough to mirror productivity with its inflation. Most DAOs with more primitive token supply systems and equivalent token price drops to 1Hive have suffered much greater drops in productivity. Increasing the Spending Limit will help us leverage this advantage.