Melon on xDAI

Proposal Information

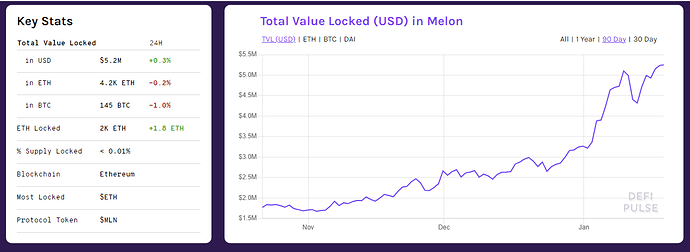

I propose we port MLN (Melon protocol) (soon to be enzyme) to xDAI and wire up for HoneySwap:

All contracts and UI, and use HONEY as the operating token

Proposal Rationale

This would allow us on xDAI to sell and make shares in decentralized trading funds initially we will only have the liquidity from honeyswap but each day more volume is added to the exchange.

Expected duration or delivery date (if applicable):

I have been playing around with contracts and the UI and i can get this fully done in around 1 weeks work time

Team Information (For Funding Proposals)

**I can take care of this:

github: scottie

discourse: scottie

discord: console#9847

xDai: 0x0Fe18f369c7F34208922cAEBbd5d21E131E44692

**

Skills and previous experience in related or similar work:

github: scottie

Funding Information (For Funding Proposals)

Lets work this out as a community.

youtube com/watch?v=1OI8l9XgD5I

Please vote: [proposal removed until further discussions are made with the community]