Due to the stagnant development of xDai necessary to improve its security it is being proposed that we migrate Honey from xDai to Ethereum, where the underlying security is magnitudes greater and there is a larger untapped market. At the same time it is also proposed that we redeploy the 1Hive governance infrastructure and common pool, currently everything accessible via 1hive.org and Celeste, including Gardens, to Arbitrum, which inherits the security of Ethereum, again magnitudes greater than xDai. However, we will continue with plans to deploy Gardens to xDai, this will require deploying a new instance of Celeste that uses the new Honey token and the use of probably an off-chain voting mechanism like Aragon Govern to govern it.

We are closely watching the development and adoption of Arbitrum since it’s launch to ensure it will be a secure and usable network and can still choose to use a different network for our governance infrastructure if necessary. However, migrating Honey to Ethereum is fairly essential at this point.

This plan isn’t set in stone and like everything here it is open to discussion so the below is subject to change.

Honey Migration to Ethereum:

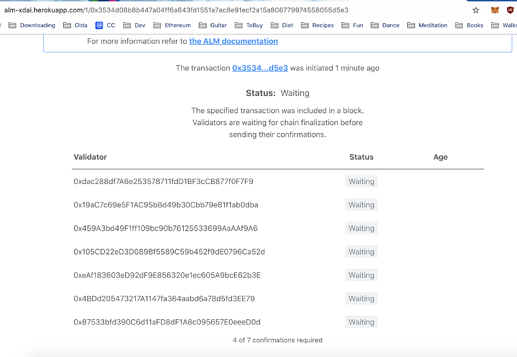

The currently proposed process for migration will require users executing one transaction on xDai, via a migration website, which will permanently burn all the HoneyV1 in their address’s account and grant it HoneyV2 on xDai. This can then be bridged directly to Ethereum or to Arbitrum via Connext (if available) or the standard bridging processes via Ethereum. DAO’s with Agents currently holding HoneyV1 will also be able to execute a transaction via a vote to migrate to HoneyV2 on xDai.

Arbitrum Garden:

To take part in the governance of the 1Hive Common Pool or infrastructure decisions or stake to Celeste on Arbitrum, bridging Honey to Arbitrum will be necessary. The Arbitrum 1Hive Garden will be the one with issuance permissions for HoneyV2 (allowing it to mint to or burn from the common pool) and it will be the governor of Celeste on Arbitrum.

Community consensus:

Ultimately to approve the above migration of core infrastructure to Ethereum/Arbitrum, a decision vote will be required in the xDai 1Hive Garden at 1hive.org. This vote will disable Issuance of HoneyV1 on xDai and burn the HoneyV1 in the common pool. The amount of HoneyV1 burnt from the xDai common pool will be minted to the Arbitrum common pool as HoneyV2.

Further details:

For technical details please see this document, PR’s for the implementation are at the bottom: xDai to Mainnet/Arbitrum migration (wip) - HackMD

Previous discussion regarding the migration can be seen here:

- Signalling proposal: Honey Pot and associated forum post: Honey Migration to Ethereum (signalling/suggestion)

- Migration swarm funding: Migration Swarm Funding