#3 What are LP tokens, how do I get these and what can I do with them?

What are LP pools?

On Honeyswap, tokens can only be swapped against other available tokens, but Honeyswap does not create these. So, in order to be able to swap, there must be ‘liquidity’ which means ‘a sufficient amount’ of tokens; these must therefore first be deposited by so-called ‘Liquidity providers’ in so-called ‘Liquidity Pools’.

Why would I add liquidity to a pool?

- To earn fees -> A small percentage is charged over every HoneySwap transaction, the swap fee. These fees are divided pro-rata over the Liquidity providers. Depending on the exact pool, the tokens, the total liquidity and growth and your share this could generate anything from close to 0% to sometimes over 100% APY (Annual Percentage Yield)

- To help jumpstart a project. Often project owners/teams supply a certain part of their native token in 1 or more pools. The first liquidity will determine the first price and from there the market can grow. But you do not need to be a project owner or a whale, even small contributions create a more stable value and make sure that trades can go ahead without much ‘slippage’: one trade will not influence the price much if there is sufficient liquidity.

- To hedge against loss of token value. This will be discussed further below in the ‘risks’ section, but basically the idea is: if one token in a pool changes value relative to the other, your capital will change accordingly, but not in the same amount. This can create a slight opportunity cost ('Impermanent Loss), but can also help in soften losses. More below.

Honeyswap only has 50/50 pools

There are different ways of defining pools, but as HoneySwap is based on Uniswap we are limited to ‘50/50 pools’. This means that in order to add tokens to the pools, you must add a pair of tokens at the same time, equally divided (ergo 50/50) so with the same value of each half of the pair.

So if 1 HNY is worth $800, and you want to add 0.1HNY ($80) to the HNY-xDai pool, you must combine this with $80 worth of xDai.

Honeyswap (https://honeyswap.org/#/swap) is the 1Hive decentralised token exchange, where you can exchange (‘swap’) different tokens, like xDai for HNY, STAKE for HNY etc.

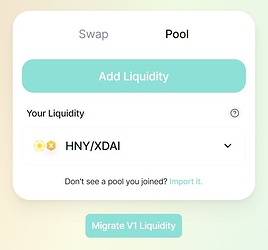

If you look at the Honeyswap page, you will see the 2nd tab, with the word ‘pool’ (slightly greyed out). If you click that, then you go directly to the heart of the swapping, the ‘pools’!

How do you add liquidity to the pools?

We’ll use the HNY/xDai pool as an example as that one will be the largest, but the following is valid for all pools.

- First of all, you must have funds in your wallet. If you already have both sides of the 50/50 pair you want to add liquidity to, then you can go to step 3

- If not, then you need to buy 1 or both coins. Fortunately, this can be done quickly and cheaply using Honeyswap. Note that if you want to add $100 in liquidity to the pool and you already have $100 in xDai, you should only use half of that to buy HNY as you need equal parts.

- Click on the ‘Pool’ tab on Honeyswap, or go directly to https://honeyswap.org/#/pool

- There is a big button saying “Add Liquidity”. Click that

- You’ll see a new screen where you can select the token pair you want to add liquidity to. Sometimes the last used token(s) are already selected, if not, click on ‘select a token’ and choose the token you want. Then do the same for the other one. See also this miniguide about how to find your pool if you can’t, separate topic.

- Choose the amount of one of the tokens you want to add and the corresponding amount for the other token will automagically get filled, based on current exchange rate.

You can also click ‘MAX’ on either side, though that will only work on the side where you have the least value in your wallet (or if both $ USD values are exactly the same at that moment). That way you will use all of your tokens.

Important! Don’t click ‘max’ on the xDai side. If so, you will pool all your xDai. This might work as there might still be enough dust left to complete the pooling transaction, but you might not be able to do anything else without adding new xDai to your wallet. So, always leave a few xDai.

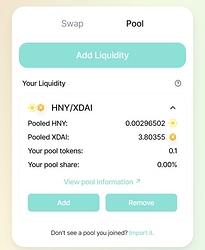

Underneath the pair you will see the exchange rate (both ways) as well as your share of the pool after you deposited the tokens.

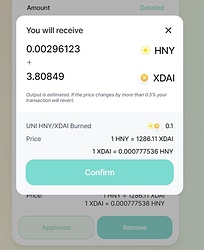

- you might need to approve 1 or both tokens first, Honeyswap will tell you and you will need to sign 1 or 2 messages with MetaMask. If you have already approved these coins before (for swapping for example), you can click “Supply” and a confirmation screen with all numbers will come up, so you can do a final check before confirming.

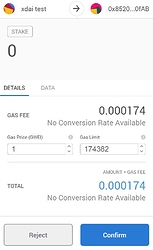

- You will get a new MM request, it will be cheap and fast because you are on xDai!

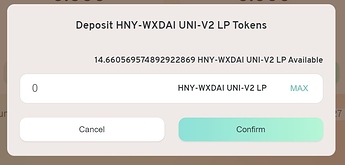

- After the deposit is made you will receive the LP tokens in your wallet. Also, if you go back to the pool page, your LP tokens and pool share should show up (even if you do not see them in your wallet, see below -> ).

Your receipt: the LP tokens

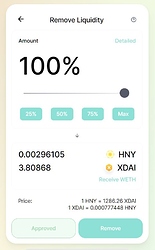

This is the same for all pairs. HoneySwap will give you a new token in return, so called UNI-LP tokens, short for Uniswap Liquidity provider tokens, which is sort of a receipt.

These LP tokens can be transferred to other addresses, but be careful with them, as without them you cannot take your deposited coins back out!

You might very likely not see them when you check ‘assets’ in MetaMask, but don’t be alarmed! They are there, just not visible. You need to add a Custom Token (scroll to the bottom of your asset list, click ‘Add token’, then ‘Custom Token’ and add the address of the token pair you LP’d to.

The current list of all pairs can be found here: https://info.honeyswap.org/pairs

Click your pair, for example, HNY/wxDai will take you to https://info.honeyswap.org/pair/0x4505b262dc053998c10685dc5f9098af8ae5c8ad

Copy that last part ( 0x4505b262dc053998c10685dc5f9098af8ae5c8ad ) and add this in the custom token top field. The rest will populate automagically, click confirm and you should see your shiny new LP tokens!

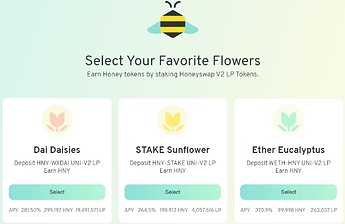

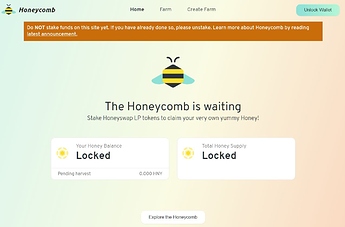

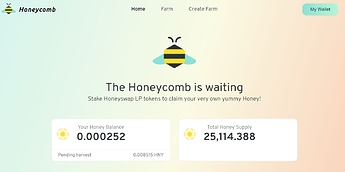

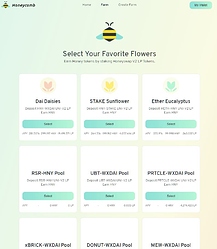

And guess what? You can use these to farm even more Honey!